Opened in 1999, Questrade is still one of Canada’s fastest growing brokerages with the reputation for being the best discount brokerage in the country. With Questrade you can utilize a wide array of different accounts such as RRSPs, TFSAs, RESPs or Cash accounts.

Whether you want to save for short-term or long-term goals, maintain an easy access to your own money, enjoy tax-free savings or invest with flexible options, Questrade has the right account for you. As a digital, low-cost alternative to traditional brokerages, Questrade is working hard to provide a better investment experience. Take control of your retirement and your financial future by opening an account with Questrade.

An account with Questrade can give you many options, you can trade in stocks, options, bonds, ETFs or mutual funds. Questrade also offers GICs, international equities, IPOs and precious metal purchases.

Features

- Actively managed portfolios – The team of experts at Questrade utilize technology to watch the market and actively adjust your portfolio. The goals are always to limit losses and maximize your return on investment.

- Easy to use and monitor – After answering a few questions about your goals, you’ll be matched with a portfolio aimed to help you reach them. After you have deposited money and your portfolio is invested, you can sit back and easily track its growth online.

- Low fees and full transparency – No one enjoys paying high fees, and Questrade understands. With no account opening or closing fees, low management fees, no trading fees and never any hidden fees, you can use more of your money for what is important, growing your investments.

- Proven returns – Four out of five of the portfolios invested with Questrade have over ten years of historical performance.

- Transfer rebates – You can transfer any account to Questrade from another financial institution and Questrade will rebate your transfer fees up to $150 per account. There is no limit to the number of accounts you can transfer.

Investment Options

There are two options for investing with Questrade:

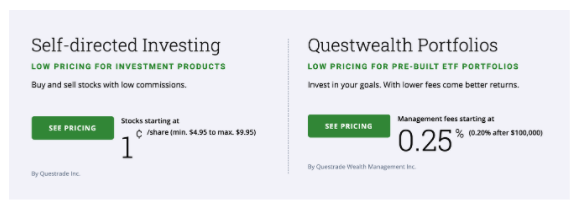

Self-Directed Investing

- Stocks as low as $0.01 per share

With self-directed investing, you will build your portfolio and then actively manage it yourself. With fast and easy to use trading platforms, you can diversify your portfolio and make informed decisions.

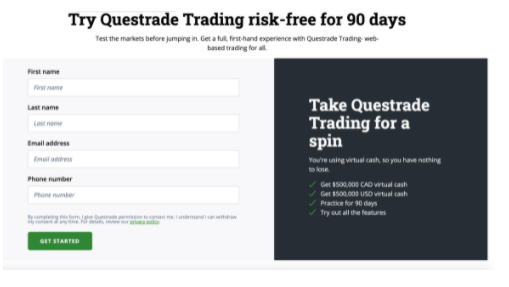

Questrade’s trading platform is available through both desktop and mobile app. It was designed to be intuitive and give you access to all of the tools you need to be successful in reaching your financial goals. They even offer a trial page that allows you to see if a self-directed investment strategy is right for you.

Questrade Portfolios

- Management fees start at 0.25%

Portfolios are designed for you by experts to help you achieve your financial goals. Questrade uses technology to build you the right portfolio and are the easiest way to invest. Determine the level of risk you are comfortable with and leave the rest to the experts at Questrade.

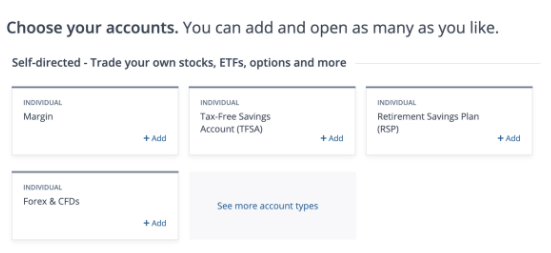

Account Types

Questrade has a wide variety of accounts to choose from. Some of the most popular accounts include:

Hold on to more of your money. All of the money made in a TFSA is tax free, and you can withdraw your money at any time with no penalty.

Save for your retirement while enjoying tax deductions on the contributions you make.

Save for short-term goals and maintain easy access to your money. There is no contribution limit, so you can invest with flexibility.

Set your beneficiaries up for a successful future. Qualify for government grants and make withdrawals at the beneficiary’s tax bracket.

Frequently Asked Questions About Questrade

What makes Questrade different from other investment services?

By providing their clients with a variety of online tools, Questrade helps the self-directed investor make the decisions they need to control their finances. With their fast and easy to use mobile and web trading applications, you can invest on your own time, pay lower fees, and see better returns. Unlike many of the large online brokers, Questrade does not charge an annual fee for any of their accounts, and when it comes to commission fees on trades, they have some of the lowest out there.

Is Questrade safe?

You can be assured that investing with Questrade is safe. The accounts are encrypted and stored securely so that you can invest with every confidence that your money is protected. They are regulated by the IIROC and CPIF and have an extra ten million dollars in private insurance.

Is there a minimum investment required?

To start trading with Questrade, your account must have a balance of $1000.

What if I don’t know anything about investing?

Questrade is perfect for first time investors, and those with limited experience. Even the most novice investor will find value in the services offered by Questrade, and if you are looking for the lowest fees over a long period of time, they will certainly fit the bill. Your money is in good hands with their team of professionals, ready to work with your financial goals and risk tolerance in order to create a customized portfolio for you.