Requiring a loan is a commonplace occurrence among most Canadians at some point in our lives. Money Mart, which was founded in Canada in 1982 offers a wide variety of different services to help their customers meet their short-term financial obligations. They are a reputable company with over 700 locations that can be found all across North America and are registered with the Better Business Bureau.

Features

- Online Services – The Money Mart Mobile app is available on both the Apple App Store and Google Play and provides an easy way to get loan approvals and loan refinancing while you’re on the go.

- Fast Cash Deposit – Typically, your loan is deposited in your account in one business day. In certain circumstances it may take up to 48 for the funds to become available, although these occurrences are rare.

- Convenient Hours of Operation – Different Money Mart locations are open for different hours of operations but some open as early as 7am and close as late as 10pm.

- Quick Approval Process – Money Mart offers a quick approval process that is required is a short application and loans can be approved as early as the same day.

- High Loan Amounts – Money Mart offers loan amounts up to $1500

Services

No matter what your financial needs, Money Mart has all of the services that you require. Whether you need a loan, a credit card or international currency for a trip abroad, Money Mart is there to assist you. For more information on Money Mart, visit https://smarter.loans/lenders/moneymart/

Some of the most commonly used services at this institution are:

Installment Loans

With a quick and easy application process and no hidden fees, Money Mart can provide you with an installment loan that is flexible enough to meet all of your financial needs and can help you build up your credit rating.

Cheque Cashing

If you have a cheque that needs to be cashed, Money Mart can help you. Their cheque cashing service can give you the money that you need, right away, whether the cheque is from a friend, your work, the government and even if it’s post-dated.

Bill Payment

For just a small fee of $1.99, Money Mart can facilitate a bill payment for you without the hassle of having to send off the bill, through the mail yourself. Their e-payment service offers a quick and reliable payment method to ensure that your bill gets paid right away.

Loan Protection Plans

A loan protection plan is an optional insurance plan that protects the borrower in the event that an injury, illness or even death prevents you from being able to make payments and fulfill the obligations of your loan.

Affiliated with both Western Union and H&R Block

Along with all of their other services, Money Mart is also affiliated with Western Union and H&R Block, making them a one-stop shop for all of your needs. Whether you need to send money across the globe or file your taxes, Money Mart is able to assist.

Currency Exchange

If you plan on travelling abroad, Money Mart can help you convert your funds so that you have enough of the local currency for all of your vacation needs. They offer competitive exchange rates for 26 of the most travelled to countries around the world and offer a buy back guarantee, for only $4.99, on all U.S. dollars and Euros, ensuring that you aren’t out anything if you don’t spend all of your foreign cash while away.

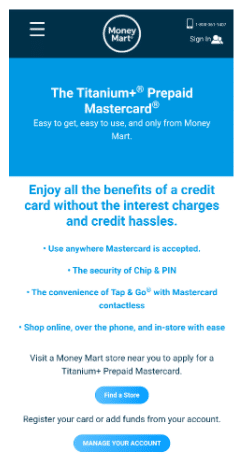

Credit Card

Money Mart provides its clients with the option to apply for their Titanium+ Prepaid credit card. This card can be used everywhere that Mastercard is accepted, even online.

Small Business Solutions

Money Mart offers a wide range of financial services for their small business customers as well. If you are the owner of a small business, Money Mart is sure to have the finance solutions that you need.

Money Mart offers approval for small business loans in under 24 hours and full financing can be provided in between three to five business days. Money Mart provides customizable and flexible payment plans to accommodate your individual business needs and also offers full support and assistance throughout the entire duration of your loan and beyond.

Money Mart offers immediate cheque cashing services to provide your business with the money it needs now, without having to wait days for your cheques to clear.

Frequently Asked Questions About Money Mart

What information do I need to provide in order to apply for a loan?

You must provide identification that proves you are at least 19 years of age, and have an active chequing account. You must also be able to prove that you have a steady and reliable source of income.

Can I still get a loan if I have poor credit?

Yes. Money Mart uses a series of detailed and specific assessment tools that determine your level of risk. Even if you have a history of poor credit, this won’t affect Money Mart’s decisions on granting you a loan and in what amount that loan will be in

How will I receive my loan from Money Mart?

Once your loan has been approved, Money Mart will either deposit your money into the bank account you have provided or it can be picked up in store.

What happens if I can’t make a payment?

Money Mart requires that you contact them directly, by phone at their customer service office to make other arrangements if something comes up where you are unable to make a scheduled payment. If you do not contact them and continue to miss payments, they have the right to take legal action against you in order to recover their funds.