Top Companies That Can Help You With Consumer Proposals

What is a Consumer Proposal?

A consumer proposal is a legally binding agreement made between you and your creditors, with the help of a Licensed Insolvency Trustee, regarding a debt settlement arrangement. Its aim is to assist you in paying back as much of your debt as you realistically can, while protecting you from debt collectors, lawsuits, wage garnishment, and so on.

A consumer proposal works on the premise that while you cannot pay back all of your debt, your creditors are better off finding an arrangement with you to get back some of their money, compared to if you declared bankruptcy, where they'd be unlikely to see any of it. It is for this reason that many creditors agree to a consumer proposal.

A consumer proposal usually means alleviating a significant portion of your debt, and eliminating interest on what you owe, in order to make realistic monthly debt payments possible. While they have many benefits, consumer proposals are a serious and significant financial decision, and do not mean becoming totally debt free - so let's look at how they work.

How Does a Consumer Proposal Work?

1. Who Can File a Consumer Proposal?

Not all debt, and not all people, are able to file a consumer proposal. To be eligible, you must meet the following criteria:

- At least 18 years old

- At least $1,000 in debt

- No more than $250,000 in debt overall (not including mortgages)

- A stable income

- No other open consumer proposals

- Financially unable to meet your debt obligations as they stand

- Able to make some consumer proposal payments

- Canadian resident

It is possible to file a consumer proposal for joint debts, for example if you share your debts with a family member or partner. In the case of a joint consumer proposal, the eligible amounts scale upwards.

2. How Much Does a Consumer Proposal Cost?

a. Debt Monthly Payments

A consumer proposal can help reduce your unsecured debts by up to as much as 70%, but each consumer proposal is negotiated between the debtor and creditors individually, so you should know each one is different and the overall amount you will have to repay will depend on your financial situation and what you can afford in terms of proposal payments.

b. Fees

There is a cost to file a consumer proposal. However, the fees associated with a consumer proposal are federally regulated by the Bankruptcy and Insolvency Act, and are factored into your agreed monthly payment, so there will be no additional charges payable by you. In your consumer proposal agreement, you can expect to see the following items listed:

- Consumer proposal fees to the Licensed Insolvency Trustee of $1,500, plus 20% of creditor distributions

- A 5% levy of creditor distributions, paid to the Office of the Superintendent of Bankruptcy

- An administration fee of $100, paid to the Office of the Superintendent of Bankruptcy

- Fees for two financial counselling sessions (mandatory)

These fees are paid from your monthly debt payments, and then your creditors receive their share of the balance. Essentially, this means that your creditors cover the cost of a consumer proposal for you. You should never be billed directly by a Licensed Insolvency Trustee for their services.

3a. What Debts Can Be Included in a Consumer Proposal?

Not all types of debt can be included in a consumer proposal. Allowable debts include unsecured debts, such as:

- Personal loans

- Lines of credit

- Credit card debt

- Payday loans

- Bank overdrafts

- Unpaid bills

- Tax debts to the Canada Revenue Agency

- Student loan payments (as long as at least seven years have passed since you graduated)

3b. What Debts Are Excluded in a Consumer Proposal?

Excluded from consumer proposals are all debts to secured creditors, as well as some other debt payments, such as:

- Secured debts (e.g. mortgages, car loan, secured credit card)

- Vehicle lease agreements

- Alimony payments

- Child support payments

- Debt associated with fraud

- Student loan payments younger than seven years old

- Civil lawsuit rewards

- Fines and court penalties

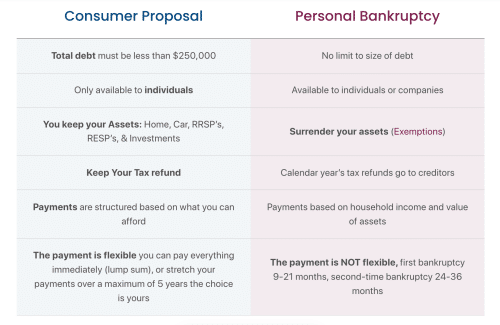

4. What Does a Consumer Proposal Mean for Your Assets?

One of the primary benefits of a consumer proposal is that it protects your assets. Whilst you must disclose your assets, investments and possessions while negotiating with your Licensed Insolvency Trustee, these items cannot be seized and your creditors will have no claim to them.

This means that you may keep your home, car, pension, and so on. However many people choose to sell high-end items, downsize their home, or make other cost-saving measures to reduce their debt and avoid a consumer proposal entirely if possible.

5. What's the Process To File a Consumer Proposal?

The consumer proposal process follows a strict structure, as it is a protected, legally binding undertaking as dictated by the Bankruptcy and Insolvency Act:

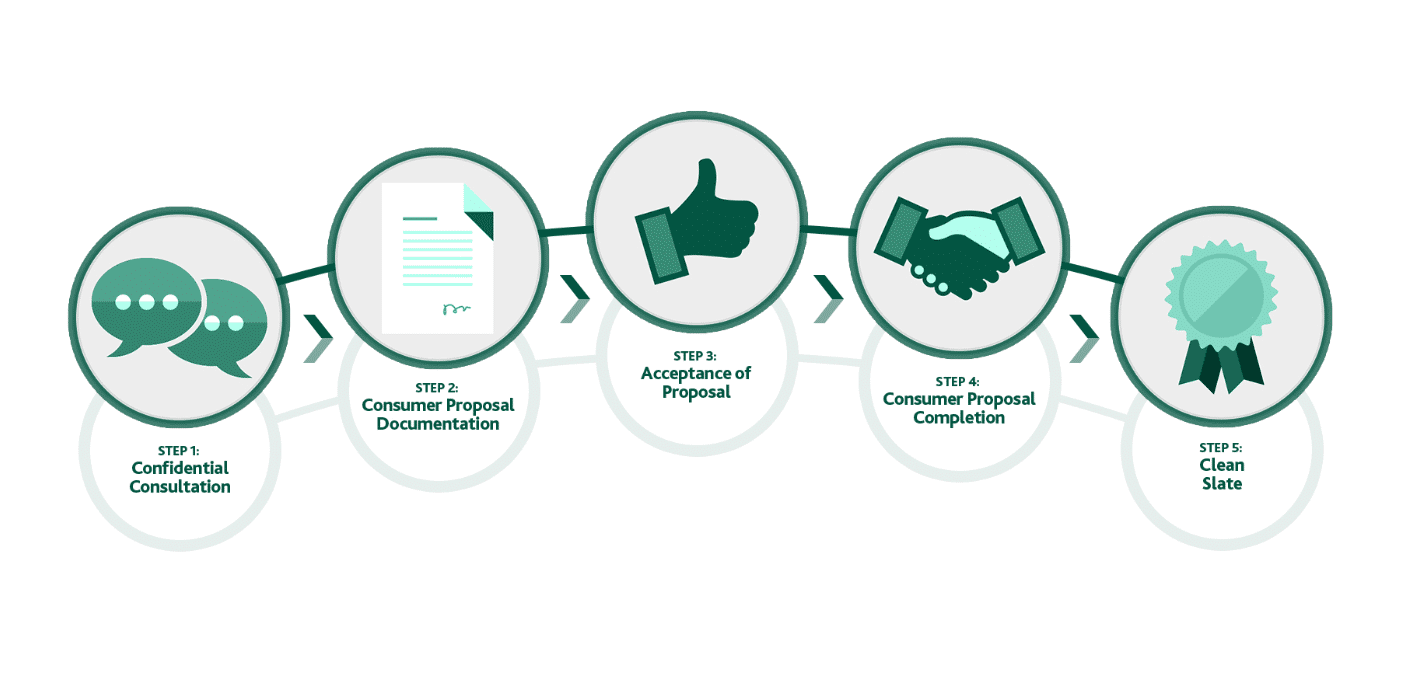

Step One - Asking for Help

Find and hire a Licensed Insolvency Trustee (LIT). This is a federally regulated professional who can provide advice and assistance regarding debt relief options, including consumer proposal services and bankruptcy services. If you cannot find an LIT, then you may be eligible to have one assigned to you via the government's Bankruptcy Assistance Program.

Step Two - Review Your Unsecured Debt

Review your financial situation with your LIT, to determine the best possible route for you. They will need to see paperwork on your debts, both secured debt and unsecured debt, income, assets, monthly expenses (including mortgage payments), and so on. They will do some calculations, and if your debt to income ratio suggests you may be able to pay some portion of your debts each month, then they may agree that a consumer proposal is reasonable.

Step Three - File a Consumer Proposal

As soon as you and your LIT agree that a consumer proposal is the appropriate debt relief solution for your financial situation, you need to hammer out the details. Your LIT will help you to assess what's a reasonable payment proposal for your financial situation, and will prepare the paperwork. You must stick to some basic terms (for example, you must be able to make the monthly payment you're suggesting, they can't be required for more than five years, and it needs to be more beneficial to your creditors than if you filed for bankruptcy). Once you are both satisfied, your LIT will file the paperwork with the Office of the Superintendent of Bankruptcy (OSB).

Step Four - Stop All Monthly Payments

As soon as your assessment is filed, you can stop making payments to your unsecured creditors (you will still need to make your secured debt payments, such as mortgage or car loan payments). Lawsuits and wage garnishments for unpaid debts owed to unsecured creditors (e.g. payday loans) will immediately stop. Your creditors are under no legal obligation to accept your consumer proposal, and each creditor will have their own criteria for accepting or rejecting a consumer proposal. Your LIT should be able to educate you about each creditor's criteria as you're crafting the consumer proposal, to avoid rejection.

Step Five - Await Response

Now your proposal must be voted on. Your creditors have 45 days to vote on your proposal, and votes are weighted by the amount owed to each creditor. It's possible that before the creditors vote, they may require a meeting. This is done if requested by a creditor, and if they are owed at least 25% of the total amount being claimed. The vote on proposal acceptance can happen at or after this meeting; if there is no meeting, the 45 day window still applies.

Step Six - Move Ahead

Approval

If your proposal is accepted, then you must adhere to the steps and payment plan set out in it. This may mean making a lump sum payment, monthly payments, or other conditions. All payments are made to your LIT, who then disperses the funds as necessary. You will also be required to attend two mandatory credit counselling sessions to help you avoid financial difficulties in the future. These sessions are usually provided by the LIT but may be via a credit counselling agency.

Rejection

If your proposal is rejected, you can try to modify the proposal to be more acceptable to your creditors, in the hopes of gaining acceptance. They may even have come back to you with amended terms that they would accept. Or, if absolute rejection occurs (rare, but possible), you must consider other debt relief solutions, such as personal bankruptcy.

6. Closing the Consumer Proposal Agreement

The consumer proposal is closed once you have met all of the conditions enclosed within. Your LIT will send you a Certificate of Full Performance to prove your compliance. Completion of the proposal means your total unsecured debt burden is wiped out, but crucially it does not mean you are entirely debt free, as your secured creditors (e.g. holder of your vehicle loan, or mortgage company) will still expect their debt repayments as normal.

If you miss payments or are late making payments on your consumer proposal, you risk having it annulled. You can only ensure a fresh financial start if you follow the proposal's requirements fully. So it's vital that, if you are struggling to meet your proposal's terms, you contact your LIT immediately to work out a solution, and possibly submit an amended proposal.

Finding a Licensed Insolvency Trustee

As mentioned above, you must use a Licensed Insolvency Trustee, licensed by the federal government, to negotiate your consumer proposal. A credit counsellor or any other type of debt consultant will not do. You don't need a referral to find an LIT, and you don't need to worry about their fees - their costs will be included in the consumer proposal. There's a list of reputable LITs in the table at the top of this page. In addition to an LIT, you may also encounter a Consumer Proposal Administrator, whose job it is to coordinate with your LIT and file/monitor paperwork as necessary.

Consumer Proposal Example for Unsecured Debt

Joe, from Ontario, holds $100,000 in debt that he is struggling to make payments on. His mounting financial challenges mean he is considering which debt relief solutions may work for him, but wants to avoid bankruptcy if at all possible. His debt burden consists of:

He also has a mortgage and an auto loan, but as both of these types of debt are secured, they cannot be included in a consumer proposal. When Joe meets his Licensed Insolvency Trustee, they perform a debt assessment, and by analyzing his income, expenses, and other financial factors, determine that he can realistically afford to repay $30,000 over the next 5 years via fixed monthly repayments of $500. This plan is presented to Joe's creditors, who vote on whether or not to accept it. His creditors might choose to accept this proposal because, to them, $30,000 back is better than the $0 they would receive if Joe declared bankruptcy.

If accepted, Joe's consumer proposal would reduce his repayable unsecured debt from $100,000 to $30,000, and his monthly payments would be frozen at $500.

Understanding the Effects of a Consumer Proposal

Filing a consumer proposal has both positive and negative effects, so it's important to weigh the pros and cons before making a decision.

Advantages of a Consumer Proposal

- Allows you to retain assets

- Once resolved, unsecured debt is cleared

- Provides clarity on financial future and consolidates debt into a single, known monthly payment that does not change

- Stops lawsuits and wage garnishments

- Stops interest from accumulating (crucial for debt with high interest rates, such as debt owed to a payday lender)

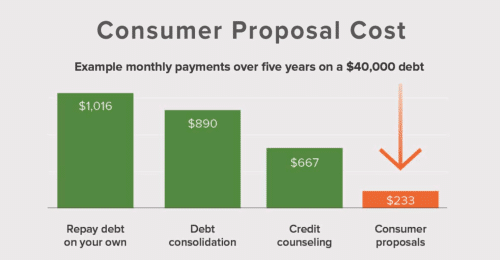

- Is often cheaper than other options

- Avoids bankruptcy

- Safe debt relief option as it is federally regulated

Drawbacks of a Consumer Proposal

- Does not entirely eliminate debt, as it does not affect debts related to secured assets, and does not eliminate or affect interest rates for secured debts

- Some portion of debt still must be paid back

- Resets your credit score to the lowest rating for at least 3 years after completion of the proposal's term

- If you miss payments, the proposal can be annulled

What Happens To Your Credit Report When You File a Consumer Proposal?

A consumer proposal will have a negative effect on your credit rating. Each debt covered in the proposal will be marked as having been discharged by consumer proposal. This has the effect of lowering your credit rating. However, chances are that if you were already struggling to pay your debts, your score was low already. And the notation of a consumer proposal has a less deleterious effect than declaring personal bankruptcy. These negative notations will be removed from your credit report either six years after you sign your proposal, or three years after you complete your proposal terms – whichever is earlier. And once the consumer proposal is successfully completed, your credit rating should improve.

Alternatives to Filing a Consumer Proposal

Not every debt situation can be resolved with a consumer proposal. Other debt relief options available to you include:

- Credit counselling

- Filing bankruptcy

- Debt management plan

- Orderly payment of debts (only applicable in Alberta, Saskatchewan, Prince Edward Island, and Nova Scotia)

- Voluntary deposit (only applicable in Quebec)

Frequently Asked Questions About Consumer Proposals

What is a consumer proposal?

A consumer proposal is a legally binding agreement between a consumer and their creditors, relating to the repayment of unsecured debts.

How does a consumer proposal work?

A consumer proposal sets out terms for a consumer to repay a portion of their debt to their creditors, without interest payments accumulating, and typically at a lower level than they would otherwise do. This means that consumer proposals are cheaper for the consumer and allow creditors to get some of their money back.

How do I file a consumer proposal?

Four items are required when filing a consumer proposal: an Assessment Certificate, a Statement of Income and Expenses, a Statement of Affairs and a Consumer Proposal. These must be submitted to the OSB. Don't worry, the LIT does all the paperwork for you!

How does a consumer proposal affect my credit report?

A consumer proposal filing will reset your credit score to the lowest possible level.

What's the difference between a consumer proposal and bankruptcy?

A consumer proposal is a less harsh process than bankruptcy. In bankruptcy, your assets can be used to help pay off creditors; this is not true in a consumer proposal - you retain your assets. However a consumer proposal relies on you continuing to pay something towards your debts, while a bankruptcy does not. In addition, bankruptcy covers all types of debt, while a consumer proposal does not affect debts owed to a secured creditor (e.g. mortgage).

Who should consider a consumer proposal?

Anyone struggling with unsecured debt, and who has a steady income, should consider a consumer proposal as a possible route out of debt.

How much unsecured debt can you include in a consumer proposal?

For single applicants, up to $250,000 can be covered in a consumer proposal.

What happens to my credit cards in a consumer proposal?

When you file a consumer proposal, you will need to hand over your credit cards to your LIT. You won’t be able to apply for a new unsecured credit card while the proposal is active. This is one reason some people choose alternative solutions, such as a debt consolidation loan.

How long after a consumer proposal can you get a credit card?

This depends; there is nothing stopping you from applying for a credit card right away, but many companies will require a minimum credit score before you can be approved. So you may have to work on rebuilding your credit once your proposal is complete, and the time this takes will depend on your income and other debts.

Can you include student loans in a consumer proposal?

Yes, but only if you graduated more than 7 years ago.

How long does a consumer proposal last?

The maximum amount of time a consumer proposal can last is 5 years.

Will my consumer proposal affect my spouse?

Your spouse will be unaffected by your consumer proposal - unless you have joint debts. In this case, your spouse may become wholly responsible for the debt once you file. For joint debts that neither of you can repay, you may be able to file a joint consumer proposal. Your LIT will be able to give advice on how to handle shared/unshared debts.

What does 'surplus income' mean?

Guidelines from the federal government exist to help LIT's calculate your 'surplus income', based on your family's size, as well as household income. If you do not have any surplus income under these guidelines, a consumer proposal is unlikely to be accepted, as creditors will assume you are unable to make the requisite payments. One monthly payment is not enough - you must be able to demonstrate you'll be able to make all payments, throughout the consumer proposal's term.

What do I do about taxes during a consumer proposal?

If you hold government debts, such as tax debt, that arose in the years prior to submitting the proposal, then the CRA will be counted as a creditor. But tax debts for the year you file the proposal through to its end must still must be paid.

Can I amend a consumer proposal?

Yes. If you are struggling to keep to the terms of your consumer proposal, speak to your LIT to see if it can be amended. It is not a given that your unsecured creditors will agree to an amendment, but it's better to try than to simply default on the agreement.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice