Best Companies, Tools and Resources for Saving Money in Canada

1.70% everyday interest, no everyday banking fees, cheap international money transfers, unlimited transactions, no minimum balance

All of Canada

Moka Plan: $3.99/month. Moka 360: $15/month

All over Canada

No Fees Savings Account, Neo Rewards provides exclusive offers and an average of 4% - 6% cashback

All of Canada

Financial Issues in Canada - The Numbers

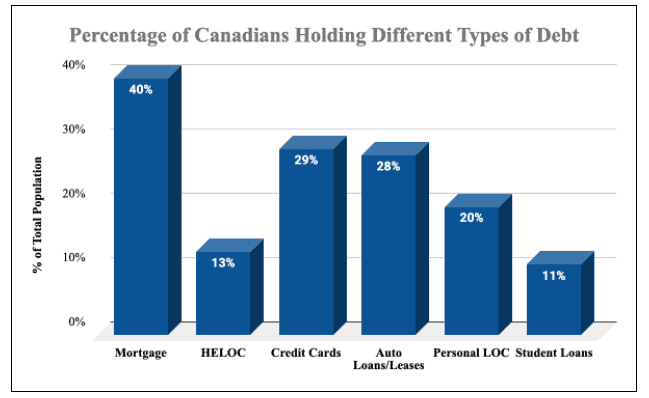

Before diving into the various tools to help Canadians with their finances, first let’s get an idea of the types of problems everyday Canadians are facing. The statistics shown below reflect the depth and breadth of the financial crisis hitting households across the country:

- The average household debt in Canada is 177% of disposable income.

- 17% of Canadians say their monthly spending exceeds their income.

- The proportion of Canadians who are failing to meet their financial commitments is rising, from just 2% in 2014 to over 8% now.

- Those under the age of 65 or with a household income of less than $40,000 are more likely to be struggling.

- 22% of Canadians report being the victim of financial fraud within the past 2 years.

- The average outstanding balance on active credit cards with money owing is $8,600.

- The average net savings per Canadian household is under $1,000 a year.

Methods for Managing Your Finances

Clearly the scale of the problem is worrisome, but there are many different ways to save money and meet your financial commitments. These methods can be used in tandem or individually, depending on your preference.

1. Budgeting

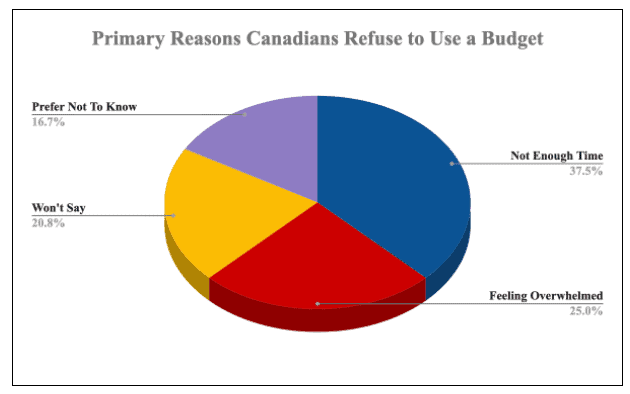

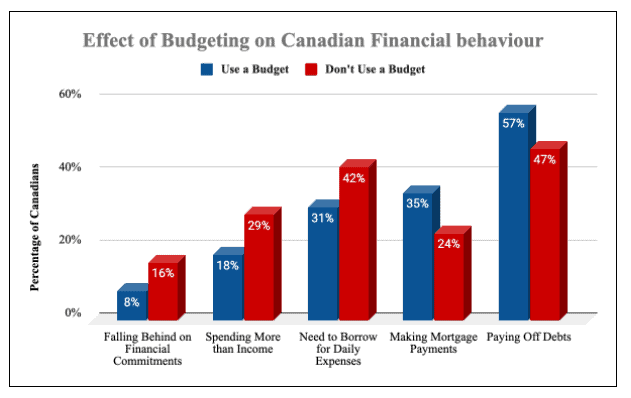

Budgeting is one of the primary ways people can manage their finances and ensure their outgoings do not exceed their income - thus avoiding falling further into debt. 49% of Canadians have a monthly budget, with the most common and effective method being a digital tool, like a spreadsheet or mobile financial app. Some of these budgeting financial apps and software are shown in the table at the top of the page; many of these are free to use and have simplified templates, to make budgeting as easy as possible.

Those not interested in digital solutions have other options, such as using cash envelopes, tiered savings accounts or other ad hoc means. Some methods rely on continuous tracking, and others on weekly assessments of remaining funds. Differing methods work for different people, and the right solution for you will depend on how closely you want to track your funds, how tight your finances are, and how technical you want to be. Generally though, the best option for you is one that will fit into your life as seamlessly as possible, be easy to check and assess, and minimize your workload.

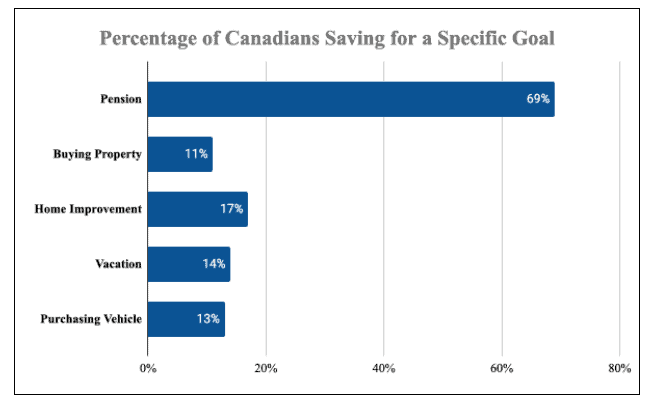

2. Saving

Saving is an important aspect of financial planning, as nearly all of us have something big we need to pay for in the future. But even without a specific goal, saving should be on every Canadian’s radar, for emergencies and the unexpected. 64% of Canadians have saved an emergency fund that is sufficient to cover three months of expenses, should anything happen to their employment, home or health.

Building savings can be part of a monthly budgeting plan, or can be achieved through one-off savings actions (such as via a work bonus or tax rebate). There are also savings apps that help people work towards their savings goals; these function through a variety of methods, such as automated deposits from paychecks, rounding small purchases up the nearest dollar and depositing the small change into savings (to build up savings incrementally as part of your normal daily spending), and other similar techniques.

3. Couponing

For those who want to minimize their necessary outgoings, couponing can be a helpful way to make the most of every dollar. Coupons provide discounts on everyday items that you would be purchasing anyway, and there are countless websites and mobile apps that offer coupons for different stores, products and brands. Some of these are even smart enough to target you with coupons that are most likely to fit with your spending habits, minimizing the amount of time you spend looking for deals. Some stores have their own weekly flyers, which can be very helpful if you, for example, shop at the same grocery store every week. And if a particularly good deal is available on a non-perishable item, you can use a coupon to bulk buy it and save money over the longer term.

4. Shopping Deals, Discounts and Sales

The various deals and discounts that stores and companies provide are an important part of financial management. None of us can go without some spending every now and then, and especially for bigger ticket items like electronics, vacations, cars and furniture, waiting for a sale or for a particular deal can save thousands. Timing isn’t always in our control, but if you anticipate a big purchase coming up, research beforehand if there will be any particular dealer or store with a sale, so you can minimize your outgoings as much as possible.

5. Cashback, Credit Card Perks & Loyalty Cards

Canadians make over three billion transactions a year on their credit cards, and almost every adult consumer has at least one. We use these tools every day, so why not benefit from their use? Different credit cards have different options and perks, and you can pick a card that best aligns with your preferences. Some emphasise cashback, so that you receive a small percentage of every transaction back as cash. Others offer reward points that allow you to redeem these points against travel or merchandise purchases. Loyalty cards, including air miles cards, also offer perks from their regular use.

The key to these tools is to use them seamlessly as part of your everyday expenditures - not to have to go out of your way or spend extra to use them. Find cards and programs that sync well with your existing spending habits, and provide the maximum benefit to you.

Choosing the Right Financial Tools

With so many different tools to choose from, it can be hard to know which is the best suited to help you with your particular financial needs. Here are some simple guidelines to streamline your decision-making:

1. Avoid any solutions that cost money to use. Your finances won’t thank you if you spend a lot on budgeting software!

2. Carefully read a software or app’s data privacy and security systems, so you stay in control of your data and secure yourself against fraud.

3. Find tools that integrate with your existing spending habits and technology. If you have to go out and buy a smartphone to use a specific budgeting app, it’s not worth your money - other options exist.

4. Find tools that minimize your workload, and be realistic about how much time you’re willing to devote to your finances.

5. Lastly, figure out what you value most. Is it flexibility? Guaranteed savings? Making your debt payments on time? Different tools have different focuses, so choose one that aligns with your end goal.

Frequently Asked Questions About Saving Money

How much should I have in savings?

Everyone has different savings needs, but it’s worth knowing that the majority of Canadians have enough savings to cover at least three month’s worth of expenses, in case there is an emergency of some kind. This is a good benchmark to start your savings journey.

How can I get out of debt quickly?

Making your debt payments on time is one of the best ways to get yourself out of debt; to enable this, you might also consider making use of a monthly budget, to ensure you have the funds to pay your debts, and avoiding any unnecessary purchases or outgoings. Transfer to lower interest debt options wherever possible, and if you’re really struggling, consider consolidating your debt to simplify your outgoings.

Does budgeting software actually help?

Yes, budgeting software can make a big difference in the effectiveness of your financial management. Research shows that those who use a budget, and in particular those who use digital tools to budget, are more likely to meet their financial commitments and less likely to need to borrow money.

How much does a budgeting app cost to use?

Most budgeting apps are free to use - or at least, offer basic functionalities for free, with cost only occurring if users choose to upgrade their membership. This is important, as a budgeting tool that costs a lot to use is counterproductive. Here are the best budgeting apps!

What’s the best credit card to save money?

The best credit card totally depends on each individual’s priorities, and how they shop. Different credit cards offer different points and cashback rates for different types of purchases. So if you travel a lot and want to save via travel rewards, the best credit card for you will be different than if you only use your card for groceries and want maximum cash back.

How can I spend less on necessities?

Spending less on necessities is a great way to meet your budgeting goals, and there are plenty of ways to do it. Maximize your use of coupons, daily deals and upcoming sales. Plan for big purchases ahead of time so that you can utilize seasonal or other expected discounts. Use a credit card or loyalty program that syncs well with your current spending habits, so you get cashback or discounts on your regular purchases. And by combining all of these methods, you can minimize your outgoings.

Written By Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice