Your employees are the lifeblood of your business. Ensuring that they receive payments in an accurate and professional way is essential for attracting and keeping talent.

Payroll software can make achieving this easy for companies of any size. With modern payroll software, you can onboard companies through cloud-based online solutions and pay workers directly to their bank through direct deposit instead of by check.

Then, you have to worry about taxes. Both state and federal. A modern payroll solution will help you handle your tax filings and payments, taking a lot off of a small team’s shoulders.

All of the solutions in this article will offer cloud-based payroll systems with automatic tax filing features. The best payroll software for small businesses is comprehensive but uncomplicated.

Let’s dive into some of the best payroll software for small businesses and examine the situations where each one might be the best fit.

Topics:

1. ADP Workforce Now

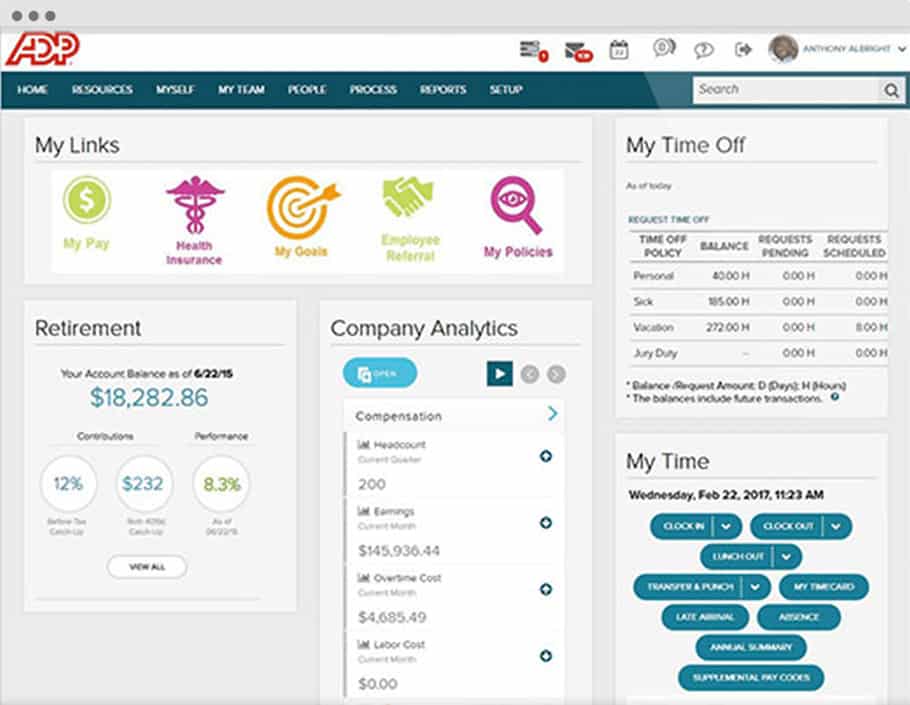

ADP Workforce Now is a comprehensive payroll software for small businesses that offers an all-in-one management solution for payroll, HR, time, talent, and benefits. For some businesses that are looking for a simple and straight-forward payroll solution, ADP Workforce Now might offer a tad too much. However, it does allow companies a complete back-office administration solution in one package, which makes it an excellent choice for many small businesses.

ADP Workforce Now delivers a self-service employee portal that offers tools like:

- time tracking

- scheduling

- PTO requests

- benefits options

The user experience for employees is often cited as one of the software’s strong points, making providing and receiving information easy. All of the standard features are available to employees through the ADP Workforce now mobile app. This self-serve portal helps to limit work by HR and finance teams, while streamlining many multi-step processes into a single step.

ADP offers deep customization with add-on modules and the ability to develop your own. For that reason, ADP primarily offers their software to enterprise companies. They are able to handle complex payrolls with thousands of employees, but are still a reliable payroll solution for small businesses.

ADP Workforce Now Pricing

ADP Workforce Now offers 4 base plans with two versions:

Pricing is only available through appointment and quote, as the number of employees and add-ons will affect the overall price.

Each of the four base plans includes different software modules:

| Plan | Modules Included |

|---|---|

| Essential | Payroll & Tax, HR Management |

| Compliance | Payroll & Tax, HR Management, HR Tools |

| Talent | Payroll & Tax, HR Management, HR Tools, Benefits Management, Recruiting, Talent Management |

| Complete | Payroll & Tax, HR Management, HR Tools, Benefits Management, Recruiting, Talent Management, Enhanced Analytics |

For small Canadian businesses, the “Essential” plan may be enough for your needs.

Conclusion

ADP Workforce Now is a big, comprehensive solution. While they mainly cater to enterprise customers, they do provide an excellent payroll solution for small businesses as well. The price of ADP Workforce Now is higher than other solutions included in this article.

One of the biggest draws to ADP Workforce Now is their excellent employee portal that automates capturing and using employee information.

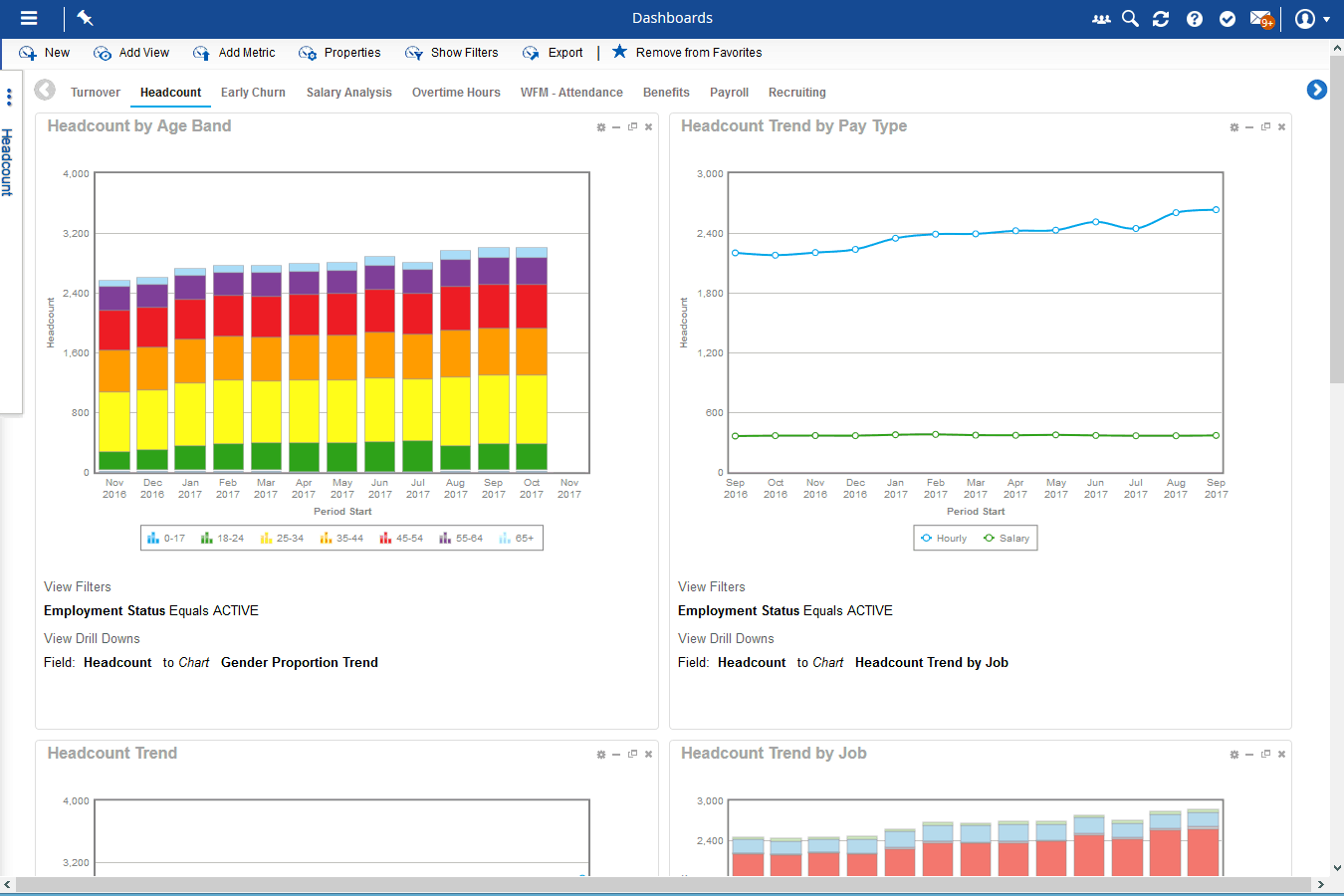

2. Ceridian Dayforce

Ceridian Dayforce is one of the biggest payroll software providers in the industry. Like ADP Workforce Now, their solution is comprehensive and includes features for HR, payroll, workforce management, benefits, and talent management.

Having all of these areas of your business handled on the same platform delivers some serious benefits, but does make it less of an ideal payroll solution for some small businesses, who are only tracking a few dozen employees.

One of the most-cited benefits of Ceridian Dayforce is the ability to customize the platform. Their system is built with flexible rulesets and real-time updates to help companies address complex regulatory requirements.

Ceridian Dayforce places a lot of focus on employee self-service. Employees are able to easily create an account and login and track their payment information from their smartphones with Ceridian’s excellent cloud-based interface. They can see a complete breakdown of their:

However, the comprehensiveness of the platform is often cited as a reason that it is hard to navigate. Users have a tendency to feel overwhelmed and bombarded with features that don’t apply to their job. The complexity of Ceridian Dayforce is a big hurdle to get over that may make the solution less viable for small companies that need something straight-forward and easy to learn. Additionally, since Ceridian is a large company, dealing with their support for very specific issues is a common source of complaints among users.

Ceridian Dayforce Pricing

Quotes for Ceridian Dayforce are provided via appointment with their sales team only. The price of their different plans is dependent on many factors including the size of your company, software features that you would like access too, and any additional services (such as implementation) that you’ll need help with.

Conclusion

Ceridan Dayforce is an industry-leader for a reason. Their payroll solutions features are vast, and the ability for employees to self-service is great for minimizing support requests. However, Dayforce can be prohibitively complicated for some small businesses. Sometimes less is more, and Dayforce tends to lend itself better to enterprise applications.

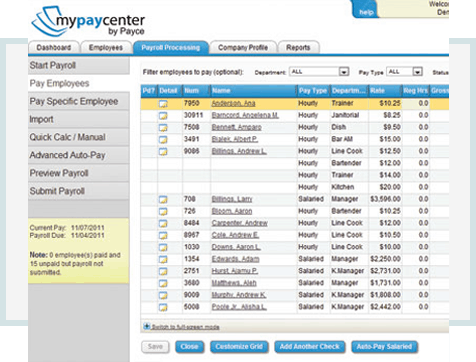

3. Deluxe Payroll

Founded in 1967, Deluxe Payroll (formerly Payweb) is one of the oldest Canadian payroll providers operating today. They typically serve smaller companies, with between 1 and 1,000 employees.

While Deluxe Payroll is a narrowly-focused payroll solution, the company offers expanded HR and employee management features through integrations.

Employees often cite Deluxe Payroll’s employee portal as simple time and attendance features as one of their defining characteristics. Also their drag-and-drop calendar feature makes it easy to schedule employees, and change schedules, on the fly. Their system can generate schedules that are optimized for both cost and coverage.

Many companies that use Deluxe Payroll stick to their standard Payroll features, and that may be the best option for many small businesses.

However, there are some commonly cited pitfalls to Deluxe Payroll in their reviews online. While the platform is considered easy to use, many find their interfaces feel a bit outdated. Additionally, their system varies based on the features that you would like access to and the number of employees. The costs can add up quickly for more comprehensive packages.

Deluxe is a popular solution among contractors, healthcare companies, food service companies, and retailers, due to the time and attendance features that make employee management easier for companies with varied schedules and higher turnover rates.

Deluxe Payroll Pricing

Deluxe Payroll does not publicly publish their prices and requires that you contact their sales team for a quote. Their pricing is dependent on the number of employees in the system and the software features that you would like access to.

Conclusion

Deluxe Payroll is an older, reliable solution for small Canadian businesses that are looking for the best payroll software. While the platform is easy to use, parts of it can feel a bit outdated at times. While you can subscribe to only the Payroll portion of their product, other feature integrations are available at additional cost.

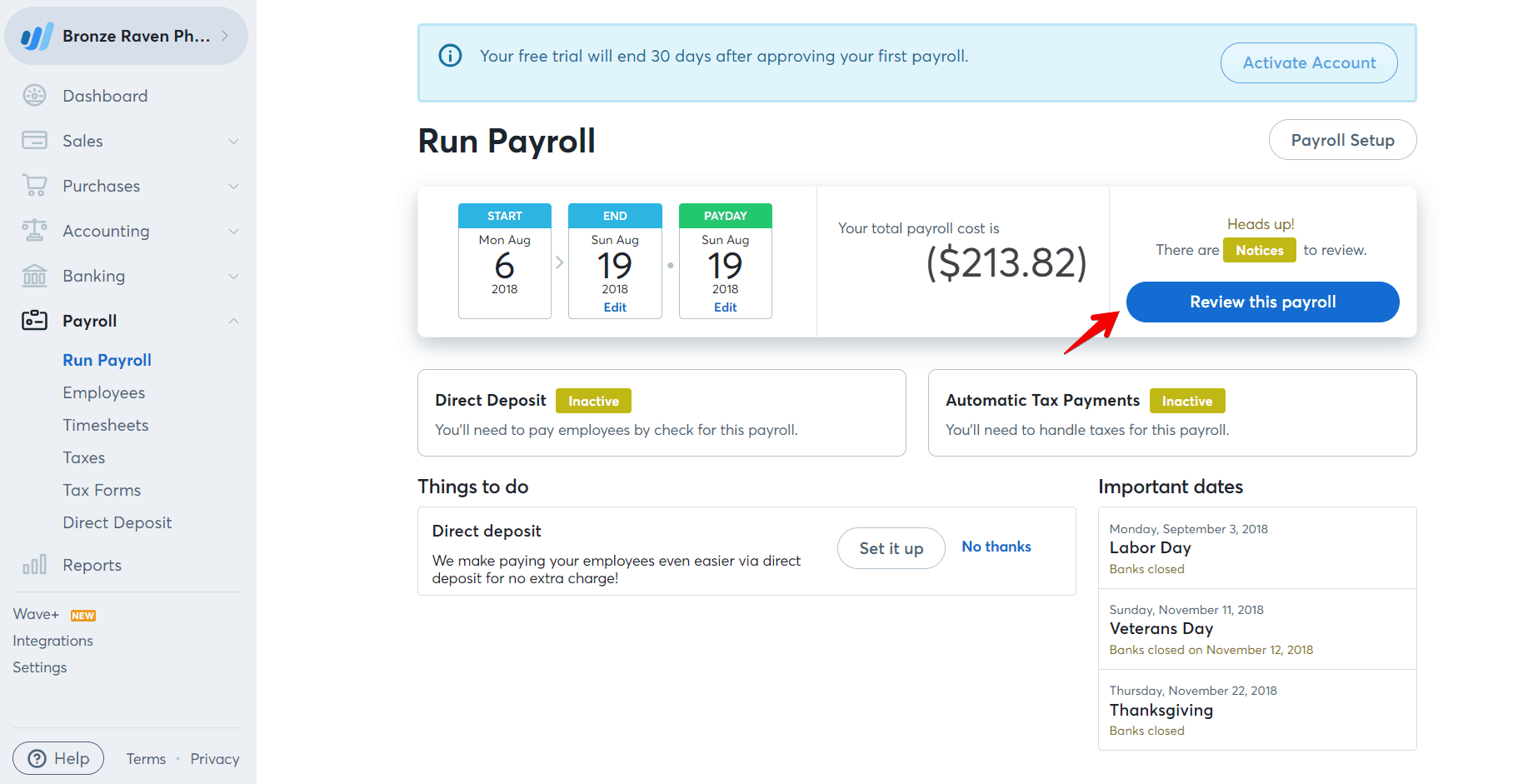

4. Wave Apps Payroll

Wave is an invoicing and payroll software provider that caters both to the US and Canadian markets. Their payroll solution is more modern and stripped down compared to the other payroll software for small businesses that we have covered in this article.

Wave Apps is known for being incredibly easy to use. With a feature set that narrowly focuses on payroll features, Wave Payroll can help companies pay their employees through direct deposit, collect automatic tax remittances, integrate with their bookkeeping software, and allow employees to access their pay stubs and T4s, and manage their contact and banking information.

For very small businesses with less than 25 employees, Wave may just be the perfect solution. Their software is incredibly easy to use, and their support is top notch. Now, Wave does come with a bit of a trade off. The comprehensive systems and additional HR features that are included in other platforms are not included with Wave. Larger companies are almost certainly going to be better-served with a larger platform.

Wave Payroll Pricing

Wave offers one base plan, with fully transparent pricing posted on their website. The price of the plan scales with the number of employees and contractors that you add to the system.

| Plan | Monthly Fee | Features |

|---|---|---|

| Wave Payroll Base Plan | $20 monthly base fee + $6 per active employee + $6 per independent contractor paid |

Unlimited direct deposits, automatic tax filings, integration with Wave Accounting, tax payment reporting, integrated employee portal, full employee management. |

Conclusion

If you are looking for the best payroll software for small businesses in Canada, you’ll be hard-pressed to find a simpler solution than Wave. Plus, with their seamless integration with their Wave Accounting product, you can easily connect your payroll and bookkeeping tasks.

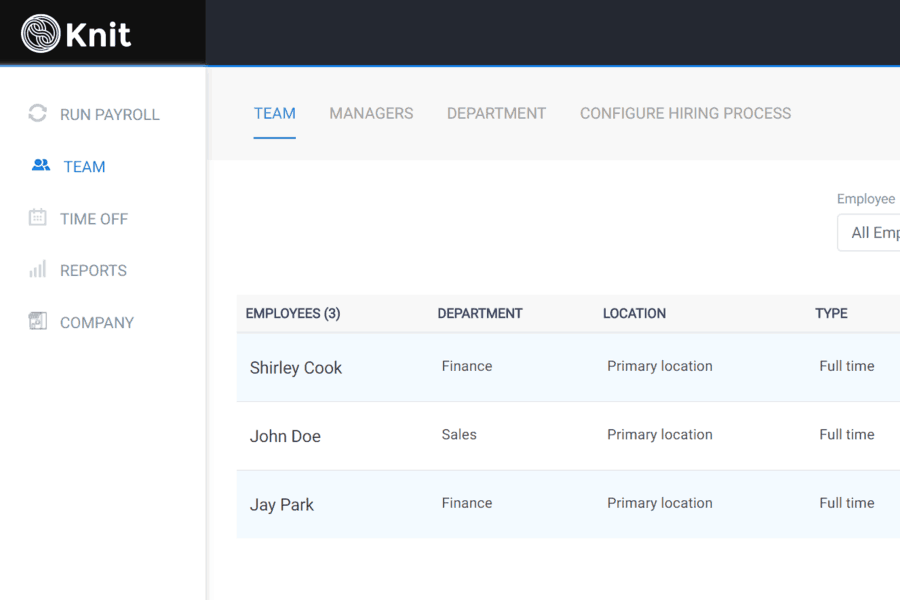

5. Knit People

Knit is a platform that delivers full payroll, HR, and benefits management. Primarily targeting small and medium-sized businesses, Knit delivers a modern interface and features that are easy to get excited about.

Unlike the fully comprehensive solutions at the top of this list, Knit People (their payroll product) is a payroll-first platform. They offer all of the basic features like direct deposit, CRA remittances, and reporting — but also offer more advanced features like WSIB remittance reporting, off-cycle pay runs, salaried employee auto-runs, and T4 filings.

Over recent years Knit has continued to expand the HR modules that they offer. These integrations are seamless, but it is factored into your pricing with Knit. Features included in this integration include:

One of the big upsides of Knit is that they offer unlimited payroll with no additional fees. Most platforms charge increasing fees for a higher number of payroll runs, but Knit does not. If you often find yourself running off-cycle payroll, then Knit may be the best solution for you.

Knit People Pricing

Knit offers three standard plans. As you step up through the plans, you unlock new features or services. Their plans have a base price, with an additional per-employee fee.

| Plan |

Pricing | Description |

|---|---|---|

| Lite | $4 per employee per month plus $39 base price |

|

| Complete | $6 per employee per month plus $39 base price |

|

| Concierge | $15 per employee per month plus $199 base price |

Conclusion

Knit People’s advanced payroll platform is perfect for small and medium-sized businesses. With unlimited payroll providing flexibility and an affordable monthly price, it’s easy to see why many companies would opt for Knit People over the competition. With additional integration options for HR, benefits, and bookkeeping, Knit is extendable, perfect for growing companies with growing needs.

Frequently Asked Questions

Yes. All of the payroll solutions mentioned in this article are available for Canadian businesses.

Some of the companies mentioned in this article require that you connect with their sales team, who will build you a custom quote based on your needs.

No. Many of these solutions offer payroll features along with other HR and operations features. However, most platforms give you control over which software modules you’ll use during the signup process.

It’s important to analyze each option independently, but yes most of these software packages will collect and send tax information automatically.