A Break Down Of Your Credit Score And What It Means In Canada

Your credit score range in Canada is critical to your financial life, yet many people don’t fully understand what it represents. Essentially, a credit score is a three-digit number, typically ranging from 300 to 900, that reflects your creditworthiness. Lenders, landlords, and even some employers use this number to gauge how responsibly you manage borrowed money – so if you are looking to get a personal loan, mortgage or borrow money in any format it is a good idea to understand your credit score.

Your score is determined by factors like payment history, credit utilization, length of credit history, and recent credit inquiries. A high score can help you receive better loan terms, lower interest rates, and greater financial opportunities, while a low score may hinder your lending options.

In this blog post, we’ll explore what your credit score really means, how each range affects your financial opportunities, and steps you can take to improve it if needed. Understanding your credit score is the first step toward achieving financial stability and confidence, so let’s dive right in!

How Credit Score Is Determined In Canada

As mentioned above, your credit score is determined by many factors and you will usually start building your credit when you turn 18. Your score is calculated using five key factors: payment history, credit utilization, length of credit history, and new credit inquiries. These factors will help Equifax determine your score and calculate if you’re a risk to the loaner or not.

Two main bureaus, Equifax and TransUnion, gather and assess data like missed payments, public records, and credit balances. Your credit score impacts everything from loan approvals to rental applications and this makes it an essential metric of financial health. If you maintain timely payments, keep your credit utilization under 30%, and avoid excessive inquiries, you’ll achieve a strong score.

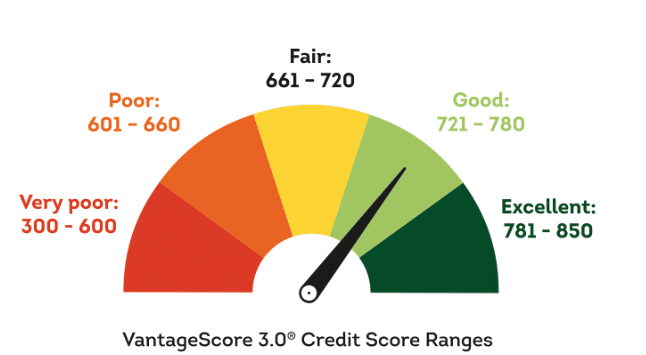

Credit Score Ranges

Your credit score will range from 300 to 900, depending on your payment history and credit utilization. Below is a credit score range chart with a bit more information about each credit tier.

300 – 559 (Poor)

A credit score range in Canada between 300 and 559 is considered poor and typically reflects missed payments, high debt utilization, or recent financial difficulties like bankruptcy. Borrowers in this range may struggle to qualify for loans, credit cards, or mortgages without significant collateral or co-signers.

If you fall into this category, you will need to work hard to increase your credit score over time. Improving this score requires consistent on-time payments, reducing credit card balances, and avoiding unnecessary hard inquiries on your credit report. This range is a starting point for rebuilding financial credibility, but with dedication, significant improvement is achievable over time.

560 – 659 (Fair)

A score of 560 to 659 is considered fair. Individuals in this range may still have some difficulty securing credit but can often qualify for loans or credit cards with higher interest rates. This score indicates financial struggles in the past or limited credit history.

If you identify with this tier, your goal should be to focus on building positive habits, such as keeping credit utilization low and paying off debts regularly. This can help move a fair score into the good range. It’s a transitional category for those working toward financial improvement.

660 – 724 (Good)

660 and 724 are seen as a good credit range. Borrowers in this range are typically viewed as financially responsible and are likely to qualify for most loans or credit products with competitive terms like lower interest for example.

If you’re in the good range, congrats! Maintaining this score involves paying bills on time, using credit sparingly, and managing a healthy mix of credit accounts. While a good score offers access to most lending options, consistent financial habits are necessary to avoid falling into lower ranges.

725 – 759 (Very Good)

A credit score range in Canada of 725 to 759 is considered very good and reflects strong credit management. Lenders view individuals in this range as low-risk borrowers and will give them access to excellent interest rates and credit options.

This range often results from a long credit history with minimal missed payments and low debt levels. Congrats if you fall into this category, but if you want to maintain it, continue making timely payments, monitoring credit usage, and keeping accounts in good standing.

760 – 900 (Excellent)

An excellent credit score (760-900) is the gold standard in Canada. Borrowers in this credit range enjoy the best interest rates, loan terms, and financial opportunities available. This score reflects years of consistent, responsible credit usage, low utilization rates, and a mix of account types.

Falling into this category means you’re on fire! Great job! To keep an excellent score, stay disciplined with payments, monitor your credit report for errors, and avoid overextending financially.

How To Check Your Credit Score

If you’re unsure as to how to check your credit score, don’t worry! It’s super simple. Checking your credit score is actually essential for managing your financial health. Start by requesting your score through free services like Borrowell or Credit Karma, which provide an easy, online way to view your credit report and score. Another option is to contact the major credit bureaus in Canada like Equifax and TransUnion, which will provide you with a detailed credit report for free, once a year or through subscription plans for regular updates.

As mentioned above, your credit score range in Canada is determined by payment history, debt levels, and credit utilization, so reviewing it regularly helps you spot any errors, monitor your financial health, and prepare for major financial decisions like applying for loans or mortgages.

How To Improve Poor Credit In Canada

Unfortunately, Improving poor credit takes a lot of time and consistency, but it’s entirely possible. The best thing would be to start by checking your credit report for errors through TransUnion or Equifax. If you notice anything suspicious, reach out for clarification or dispute inaccuracies, as they may be lowering your score.

Another thing that can help is focusing on paying bills on time, as payment history is one of the biggest factors affecting credit. If you have outstanding debts, create a budget to prioritize paying them down, starting with high-interest accounts.

Lastly, keep your credit utilization below 30% of the limit to avoid maxing out your credit cards. This will help bring your score up quite substantially but always remember to be patient! Credit improvement takes months of consistent effort and if you take the right steps, you can gradually rebuild your financial health.