Top Wealth Management Companies in Canada

1.70% everyday interest, no everyday banking fees, cheap international money transfers, unlimited transactions, no minimum balance

All of Canada

0.4% - 0.5% fee, plus 0.2% for ETF purchases

Canada, USA, United Kingdom

No Fees Savings Account, Neo Rewards provides exclusive offers and an average of 4% - 6% cashback

All of Canada

What is Wealth Management?

Wealth management is one of those broad terms that many struggle to define, and this is in part because it describes several different functions. Wealth managers are essentially high level professionals who take care of some or all aspects of their clients’ money. This can be anything - from providing access to investment vehicles, to helping you save for your pension. They charge a fee (often a set fee, but this can be a percentage-based fee), and in return they can perform a number of services.

The benefit of wealth managers is that they are a one-stop-shop. Instead of hunting around, utilizing different providers and finding advice in different places, and then trying to integrate it all into a coherent financial plan by yourself, a wealth management firm can do this all for you. Most are therefore generalists - though specialists do exist if you only need help in one area. Many wealth management services are now available online, making them even more convenient.

What Services Do Wealth Management Firms Provide?

As wealth management is such a diverse field, there isn’t an exhaustive list of everything a wealth management firm can do. These are highly trained professionals after all, and if you need a financial service, no matter how bespoke, there will be someone who can help you.

However there are some common areas that wealth management firms help Canadians in. These are:

- General financial advice

- Investment advice

- Estate planning

- Tax planning

- Retirement planning

- Business planning

- Debt management

- Brokerage services

- Access to company-specific investment products

- High net worth services

Choosing a Wealth Management Service

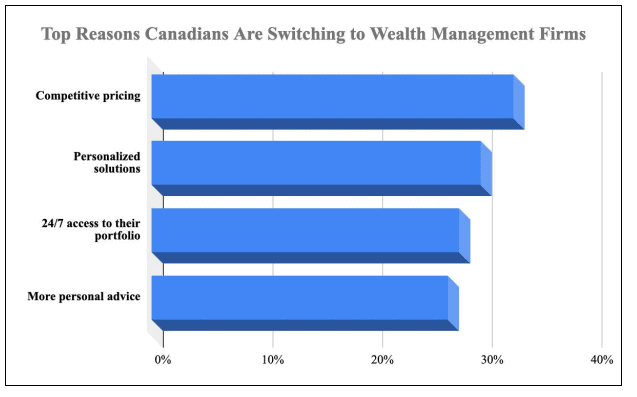

Although there are hundreds of different wealth managers and wealth management firms in Canada, 65.6% of all assets under management are handled by the top ten firms in the country - of which five are the big banks. The top five banks in Canada manage money for 90% of all Canadians. This is changing though. Consumers are becoming more financially literate, and with online access to money management tools becoming the norm, everyday Canadians are growing in their confidence to move away from the perceived safety of their bank.

When considering your finances and financial future, there are a few questions to ask yourself, to help you better understand which wealth management services to explore:

- What do you need help with? Everything financial, or just a single goal, like saving for retirement?

- Do you have any debts or upcoming expenses you need to save for, but don’t know how?

- How much wealth do you have to manage, and do you want someone to invest your money for you?

- Do you expect to have more financial needs in the future?

- If so, consider a firm that you can grow with.

- Do you want to have a single point of contact, so you always speak with the same advisor, or are you more concerned about convenience and being able to access tools yourself online?

- How much are you prepared to do yourself?

- How much are you prepared to pay in fees?

These questions will steer you towards the type of company that can best help. The balance essentially needs to be between what you are willing to pay for, and what services you desire. If you pay more, you’ll get more comprehensive and personalized help.

Choosing a Wealth Management Firm

When looking at specific companies within your chosen area of service, consider the following:

- How easy is it for you to access the company’s services?

- How expensive are they compared to their competition?

- Are their fees set, or variable?

- How are their advisors paid? If investing, you want to avoid those companies who reward employees for taking risks with your money.

- Do they have restrictions on what they can or can’t do?

- Do they have requirements for their clientele, such as a minimum account size?

- What’s their reputation like?

- If it’s an investment-based firm, how do they manage their investments, and what’s their track record like?

By carefully considering your needs, and matching them with a company with a solid reputation, you can ensure you’re making a smart move towards your financial goals.

Frequently Asked Questions About Wealth Management

How much money do I need to use wealth management services?

That depends. Some wealth management companies are geared specifically towards high net worth individuals, and as such they may have a minimum account size. Among this type of provider, this minimum can range from $250,000 to $2 million. Other providers are more general in their services, and do not have this requirement. These make up the majority of Canadian financial services firms, and the majority of their clients are regular folk without a lot of assets.

What can a wealth management firm help me with?

A wealth management firm can help you with all aspects of your financial life - from tax planning, to investments, to debt management. Many online firms are utilized for their brokerage services.

How do I know I’m using a reputable firm?

Always check a company’s past customer reviews before opening an account with them. This is the surest way of checking how they treat their clients. It may also be a good idea to check to see that they are registered with the provincial authority designated to oversee them, or if they have been levied any fines or penalties for past conduct.

Are my wealth managers fees tax deductible?

Unfortunately, wealth management fees are not tax deductible, but a wealth manager can help you with your tax planning so you can optimize your tax burden as much as possible.

Can I manage my money online?

Many wealth management companies offer online brokerage services and online advice, so yes, it is usually possible to perform much of your financial management online. If this is important to you, check with your company to make sure they provide this kind of access.

What’s the difference between a wealth manager and a robo advisor?

A wealth manager is a person who can analyze your financial health, life and portfolio to help you in whatever ways you need. A robo advisor is an automated service on a digital platform that uses complex algorithms to help you with financial planning. Sometimes these advisors simply alert you to specific circumstances, and sometimes they will trade for you to optimize your investments - depending on what kind you use. They run with little to no human supervision and so do not offer the personal level of care that a wealth manager does.

Who regulates wealth management companies in Canada?

Every province in Canada has their own financial services regulatory authority that oversees financial advisors and financial services in that province. There are also authorities regulating specific types of financial activity (for example, mutual fund dealers are regulated by the Mutual Fund Dealers Association of Canada). In addition, there is the nationwide Investment Industry Regulatory Organization of Canada. This spectrum of authorities may seem confusing, but all wealth management firms in the country performing legitimate business will happily tell you who they are regulated by, so you can confirm their standing.

Written By Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice