Top Financial Apps in Canada

Variable % of transfer amount + flat fees. Enter transfer details for a quote

Worldwide

0.4% - 0.5% fee, plus 0.2% for ETF purchases

Canada, USA, United Kingdom

Free Account Available. Premium Account with 2% cash back is $9/month or $84 annually.

All of Canada

Moka Plan: $3.99/month. Moka 360: $15/month

All over Canada

Sole Proprietorship: $89 - $120.50. Incorporation: $594 - $700.50.

Ontario, Alberta, British Columbia

No Fees Savings Account, Neo Rewards provides exclusive offers and an average of 4% - 6% cashback

All of Canada

Price Varies by amount of Gold/Silver You Buy

Worldwide

What is a Financial App?

A financial app is a downloadable, mobile financial management tool that can be used for a variety of purposes. Typically, financial apps integrate with the other financial aspects of your life, and are therefore simpler to use than standalone budgeting methods, and much more accessible than traditional wealth management tools.

Financial apps have a wide range of uses, including:

- Manage a budget

- Save money

- Pay bills

- Manage invoices and receipts

- Pay off debts

- Make and manage investments

- Buy or trade stocks

- Check credit score

- Currency conversion

- Manage credit scores

- Manage shared expenses

These apps rely on users either manually inputting data or linking their bank accounts, credit cards and other financial details into the app, so the app can automatically track their use.

How to Use a Financial App

The majority of people use financial apps for two main purposes: tracking spending, and paying bills. A massive 92% of 18 to 37 year olds report using financial apps for just these reasons. And at this level, using a financial app is very simple:

- Research which app will be best for you

- Download the app

- Input your personal information

- Link with bank accounts or cards (if applicable)

- Monitor spending and manage budget and bills through the app

For those hoping to achieve a little more through their financial app, such as managing an investment portfolio or trading stocks, then there are plenty of options for you too. Many of these apps work on a similar premise to the above, but simply require more interactive use from you on an ongoing basis. All of the apps are designed to be user-friendly and practical for people with any level of financial literacy.

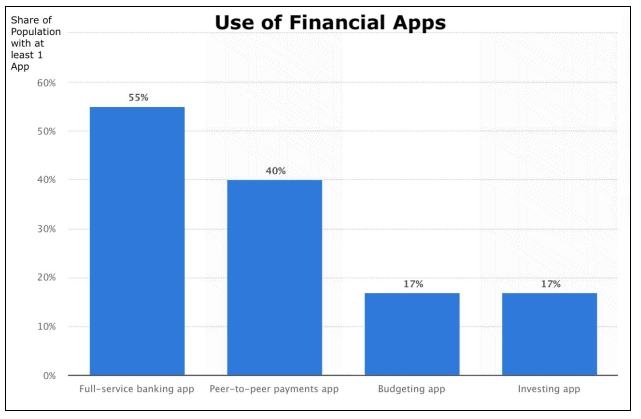

Major Types of Financial App

There are a few major types of financial app - although one or two of the major players offer cross-functionality. In general though, they fall into one of the following categories:

Budgeting Apps

- 49% of Canadians use a monthly budget, and budgeting apps help you to stick to yours by logging all of your spending. Budgeting apps allow you to:

- Categorize expenses

- Analyze spending by time period, family member, store, etc.

- Search past financial information

- Set up regular payment calendars

Receive reminders of bills

Debt Payoff Apps

Debt payoff apps help you to manage your ongoing expenses, highlight problem areas, keep a balanced budget, and make payments towards your debt - all to help you move towards debt-free status as quickly and practically as possible. Some of these apps utilize extra cash in your account to make smart payments towards your debt.

Wealth Management Apps

Wealth management apps combine everyday financial planning with long term investment strategies, so you can manage your assets and investments, and optimize. They also allow you to cross-analyze your investments by region, type, risk, and so on, to properly understand your portfolio as a whole.

Investment Apps

Investment apps allow you to proactively make investments, buy, sell, trade, and otherwise engage in varied financial markets. These apps are not just for the super-rich; you need very little money to open an online brokerage account, and micro-investing apps are becoming increasingly popular.

Investing can be very active with frequent trading (i.e. day trading) or more passive. You can learn about day trading at Wealthsimple, which is one of the most popular trading apps.

Bill Payment Apps

Bill payment apps allow you to track, monitor and automate your bill payments. This helps you to avoid late fees and penalties, keep track of big expenses coming up, and stay on top of your budget.

Bookkeeping Apps

Bookkeeping tools are nothing new, but the mobile apps now available make bookkeeping much easier than ever before. These accounting tools allow you to record and monitor your business’s finances, without the need for an accountant!

Benefits of Financial Apps

There are many benefits to using financial apps, including:

- Accessibility. These apps can be used anytime, from anywhere, meaning you can manage your finances as is convenient for you.

- Integration. Good apps will integrate with other online tools (such as banking) for your convenience.

- Personalization. Many of the better apps use personalized notifications and tools that are geared towards your specific needs, spending habits and debt level - meaning the app delivers a higher level of service for no extra cost.

Improved financial literacy. A financial app is a simple way to understand and manage your money, and as you navigate the easy-to-use tools they offer, your financial literacy will increase, as will your confidence in managing your own finances.

- Improved long-term financial health. Financial apps can help you to understand how to meet your financial goals, helping you towards better long-term financial health.

- Fraud detection. It is easier to spot discrepancies or fraud using financial apps, and issues can be more rapidly flagged. Many apps have automated fraud detection built-in to do just this for you.

- Security. Many mobile financial apps require biometric security, such as your face or a thumb print, which is safer than online banking which uses a simple password.

Risks

There is no such thing as a completely secure mobile technology, and fraud is one of the most common concerns surrounding financial apps - especially those that link to bank accounts and credit cards. At particular risk are apps which do not supply the same level of security as you’d expect with online or mobile banking. This happens because third party providers are not under the same scrutiny or regulatory requirements as financial institutions.

In practice, suspect apps can sometimes be easy to spot (for example, the app displays your full account numbers), or might be harder to identify (for example, if a platform does not utilize end-to-end encryption). It is extremely important to make sure you are using a secure, reputable app for your financial management.

On a similar note, identity theft is sometimes a concern for financial app users, as financial apps hold almost all of your personal information in one place. Again, this means ensuring the safety of the app you use is paramount.

How to Choose the Right Financial App

Choosing the right app for you need not be complicated. Simply follow these guidelines:

- Have a goal. It’s important to know what you want to use the app for; don’t get side-tracked by flashy functionality you won’t ever use.

- Understand what features you need; for example, if you need an app that integrates with your mobile banking, check this functionality is available. If you’ll only be using an Android tablet, check the app is compatible.

- Research the reputation of the app and provider to ensure your ongoing financial security.

- Understand the cost of the app (if applicable), and the time you‘ll need to input to successfully utilize it.

- Keep your personal information safe, and only input what you have to, ensuring you utilize all available security features with each use.

Frequently Asked Questions About Financial Apps

What is a financial app?

A financial app is a downloadable, mobile financial management tool that can be used for a variety of purposes, including managing a budget, saving, investing, managing shared expenses, managing your credit, and much more.

How do I use a financial app?

Financial apps are generally pretty easy to use. You can download them onto your phone (or tablet), and then input your personal information. Many link with your bank accounts and credit cards so that data entry is automated. You can then use the app for the purpose you need - managing a budget, investing, saving, and so on.

How much do financial apps cost?

The cost of financial apps vary; some are free, others have some functionality for free and then require a fee for more advanced use, and others require a subscription or have a download fee. Be sure to thoroughly research the cost structure of the apps you are considering, to understand both their initial and ongoing costs.

Are financial apps safe to use?

Financial apps can be safe to use, if you go with a reputable company. Good financial apps will have security measures on par with mobile or online banking, but there are providers who do not take these precautions. Thoroughly research a company before downloading its app to ensure it’s safe.

Can I link my financial app to my bank account?

Many financial apps will allow you to link your bank accounts, credit cards and investment vehicles to your app, so that you can seamlessly manage your finances from one location. Ensure the app you are looking at has this option before you download it though, as some apps require manual data entry.

What’s the best financial app available?

There are many different financial apps available, for all sorts of purposes, so choosing the best one for you depends on what you need it for. There are some multi-purpose apps that offer lots of different functionality, so if you’re hoping for a one-stop-shop for your money management, one of these is probably the best bet.

Why would I use a financial app?

You can use a financial app for many different reasons: saving, paying off debt, automating bill payments, maintaining a budget, investing, managing assets, managing shared expenses, and so on. Almost any aspect of personal finance can be handled through a dedicated app.

Do I need to be rich to use an investing app?

Absolutely not! The barrier to entry for investment apps is very low, and many do not have a minimum threshold. There are in fact an increasing number of micro-investment apps geared specifically for those hoping to make small investments rather than big ones.

Written By Smarter Loans

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice