Top POS Point of Sale Solutions in Canada and US

Quick Links:

- What Is Point of Sale Software?

- What is Cloud-Based Point Of Sale Software?

- How Does POS Software Work? — Onsite vs. Cloud POS Software

- Who Uses POS Platforms?

- What Are Some Of the Key Features of a POS System?

- How Much Do POS Systems Usually Cost?

- Finding the Right POS System For Your Business

- Frequently Asked Questions about Point of Sale Solutions

What Is Point of Sale Software?

Point of sale software is the software that brick-and-mortar retailers use to conduct sales and checkout customers. Point of sale software tracks your products, calculates the cost of the sale, and facilitates the financial transaction.

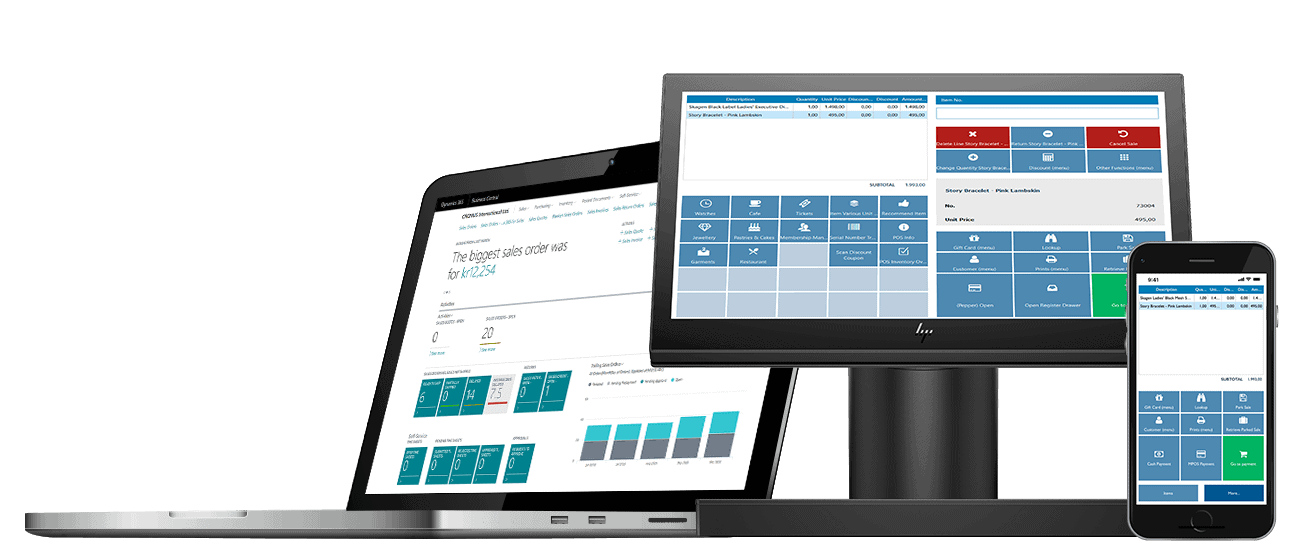

Traditionally, most companies used cash registers. Today, the options for point of sale hardware can take many different forms. It could be a register, a computer, or even a tablet device. 48% of retail workers prefer using a mobile POS system.

While not true of all POS systems, most modern systems also either natively track or connect with systems that track inventory levels in your store. Then your current counts are always automatically tracked and you have an updated log of your current stock levels. They have grown from being systems that were mainly concerned with checkout, to being broader systems that help businesses in many areas of their business.

Big box stores may use their own custom-built solution. However, most smaller retailers buy into standard packages for their POS software and hardware systems, often with optional upgrades and features that can be attached to the base plan.

There are typically three types of POS software systems that you can buy into.

- Terminal (cash register style)

- Mobile (tablets)

- Cloud-based (online software)

Before diving into more specifics about point of sale systems, it’s important that you understand what a cloud-based point of sale system is, so that you can differentiate between the options available to you.

What is Cloud-Based Point Of Sale Software?

A recent trend in the POS software industry is the rapid growth of cloud-based systems. Cloud-based systems can be accessed directly from the internet, which means that in theory, you could access your POS system data from any device with an internet connection. Some of them have apps available, making it easier to access data or make changes directly from your mobile device.

With a cloud-based POS system, you may have other pieces of hardware like cash drawers or credit card readers that integrate with the system as well.

Often, cloud-based POS systems are not as expensive and preferred because they offer the ability to access your data from outside of the store. While they may not be ideal for enterprise companies, cloud-based solutions often make the most sense for smaller stores.

For small businesses that operate both a brick-and-mortar location and E-commerce website, a cloud-based option may be the best choice because it allows you to connect to separate areas of your business into one system. Additionally, a cloud-based system would be ideal for any business that sells at trade shows, flea markets, and other gatherings.

Having that top-down view of your data from anywhere and connecting separate aspects of your business can help companies to improve ordering accuracy and ensure that they stay on top of their inventory.

How Does POS Software Work? — Onsite vs. Cloud POS Software

Onsite POS Software

- Software is installed locally, on a computer or server, located at your place of business.

- Typically requires that you purchase a software license.

- Onsite POS software often requires maintenance and comes with some data loss risk if you do not back up your data.

- Does not require the internet to access your system.

Cloud-Based POS Software

- Your system data is stored online, on servers provided by your POS company.

- Your data can be accessed from anywhere, usually using any internet-connected device.

- Known as software-as-a-service (SaaS). Typically a monthly fee to access the software.

- Updates are delivered automatically with no download or software maintenance required.

Who Uses POS Platforms?

Who uses POS platforms? Well, everyone. Or at least any business that accepts payments from their customer in-person and not solely online. POS systems are used in any industry that sells products from a physical location.

Any company that does even modest volume for a small store requires a POS system to stay up to date, check out customers, and keep track of their inventory. Sure, you could technically do it all by hand. But your competitors aren’t. And you don’t want to get left in the dust.

Big box retailers like Macy’s, Target, or Best Buy use them. So do small local businesses, restaurants, and your local corner store. As well as sellers at your local flea market or outdoor event.

Everyone who sells their products in person uses a POS system.

What Are Some Of the Key Features of a POS System?

As you evaluate point-of-sale systems, one of the key evaluations that you will need to make will be the features offered by the individual systems.

But this can be a bit of a chicken-or-the-egg scenario if you don’t know exactly what you are looking for. Before deciding on POS software, you must determine the features that you will need, based on how you want your operations to run.

Some of the basic functionality that is included in most POS systems include:

- Billing and Order Processing. The ability to take orders and process credit cards.

- Sales Monitoring and Reporting. Monitor and report on your sales down to the product.

- Inventory and Stock Management. Keep a watch on your inventory and stock management.

- Cross-Channel Returns Management. Allow returns both where the item was purchased, at another store, or online.

- Customer Relationship & Experience. Track your interactions with customers and take notes to provide better experiences during future visits.

- Employee Management. Keep track of who was working when and the sales that they generated during their shift.

- Gift Cards. Accept gift cards just like a big box store.

- Loyalty Programs. Track customer loyalty incentives and manage rewards and gifts through one platform.

Now, all of these features might not be important to you. It depends on your situation. But these are the core features that are included or purchasable with most point-of-sale software packages.

Taking stock of what is important to your company will help you to make the best possible decision, so put some thought into what features you would like to have before you begin your search.

How Much Do POS Systems Usually Cost?

The price of a POS system can range a lot based on many factors. First, you can expect an enterprise or high-volume solution to cost substantially more than it would for lower volumes, especially in cloud-based systems. That’s universal across almost all POS systems. Others may require that you buy hardware upfront.

A point-of-sale platform can be a big, but necessary investment for any retail company. But it is important to understand that many modern POS systems are not just there to facilitate the sale, but to help you organize and manage your business as a whole — tracking inventory, logging employee actions, managing relationships with customers, and helping you to manage your daily scheduling.

Legacy POS systems would have cost you $5,000-$10,000 for the hardware alone, and that is without setup and maintenance.

With modern POS systems and particularly the cloud-based systems, you can usually have a single-register setup for less than $1,000, with a monthly fee.

However, there are many variables. Some of the potential costs of a POS system, depending on the one you choose, could include:

- Software pricing. The software itself will have a cost. In modern cloud-based solutions, you pay a monthly fee, typically between $20 and $250 per month, depending on your needs.

- Hardware costs. Although sometimes bundled into packages with the software, you will often have to have to pay for a card reader, tablet, computer, terminal, or other pieces of hardware. Some of these will be a requirement for the POS system, but there may also be optional inclusions.

- Add-On services & integrations. Along with optional hardware, most popular point of sale software systems also offer optional add-on services, features, and integrations. These could be things like gift card features, loyalty programs, or direct connections to another customer relationship management tool.

- Number of registers. The number of registers in your business is a key consideration when factoring the cost of a point-of-sale software package. If you have five registers, you can expect to pay five times as much in hardware costs as if you had one.

- Contracts. Is your company being billed monthly, quarterly, or annually? Longer commitments lower your dollar amount significantly.

- Payment processing costs. This is another big consideration that can range from one POS system to another. Typically, most payment processing costs fall into the 2%-3% range. However, even with the same POS system, the payment processing costs may differ depending on what plan you choose.

Finding the Right POS System For Your Business

A point-of-sale software system is a big investment for any retailer. There is a lot to consider. Before making your decision, ensure that you have a solid understanding of all of the options available to you, and how POS software packages are typically structured. With so many add-ons, options, and different types of hardware and software setups, it can be a tangled web to navigate.

Frequently Asked Questions about Point of Sale Solutions

What is Point of Sale Software?

Point of sale software is the software that brick-and-mortar retailers use to conduct sales and checkout customers.

What Features Does Point of Sale Software Include?

The features offered from one system to another can vary, but typically POS software includes features like billing and order processing, sales reporting, inventory and stock management, return management, customer relationship management features, employee management, and loyalty programs.

What Does Point of Sale Software Cost Monthly?

Pricing depends on a number of factors. On-premise POS systems typically cost more than cloud-based systems with software integrations. Also, each system may price differently — per user, or revenue-based pricing. Typically, software-as-a-service point of sale systems cost anywhere between $20-$1000 per month, depending on your needs.

Is POS Software for e-Commerce Companies?

No, POS software is typically used by brick-and-mortar companies.

Written by Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star in 2019.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice