Top International Money Transfer Companies

Variable % of transfer amount + flat fees. Enter transfer details for a quote

Worldwide

Free Account Available. Premium Account with 2% cash back is $9/month or $84 annually.

All of Canada

What is a Money Transfer?

A money transfer is when one person transfers funds to another; money is deducted from your account, and added to the recipient’s. This can be done very easily, sometimes with little more than each person’s name and contact information, and many companies offer money transfer services online for a small fee. Money transfers can be done both within Canada, and internationally, utilizing foreign currency exchange.

It’s important to note that money transfers are distinct from online banking; we’re not talking about paying basic bills or moving funds between your personal accounts. Money transfers are about sending money from one person to another, often in another country.

How do Money Transfers Work?

There are a few different intermediaries you can use to perform a money transfer:

- Money transfer company

- Bank

- PayPal, WePay or other online payment service

- Post Office or other physical location offering limited banking services

Money Transfer Companies

Money transfers via dedicated money transfer companies are surprisingly easy; you need access to the bank account you are sending money from, and at the very least the name and some form of contact (cell phone or email address) for the person you are sending money to. If you are sending money internationally, you will probably need more information than this, such as the recipient’s banking information.

You can set up a transfer entirely online. If it is an international transfer into another currency, you will have the opportunity to see the exchange rate they offer before you commit. You will also get to see the fee that the money transfer company charges. There are often limits on how much you can send at once, or within a set period of time. Once you submit the money transfer, funds are deducted from your account immediately, held by the transfer company, and then routed to the recipient. Depending on where money is being sent, the funds should arrive in the recipient’s account within a few business days.

As some money transfer companies offer both online services and physical locations, it is possible to set up a transfer online for the recipient to pick up physically, in person, at a dedicated location - if they have a branch near them. To do this, they would need to have the transaction number and appropriate ID.

Banks

Many people use their bank (often via online banking) to send money. This can be done in much the same way as with a money transfer company, and the benefit is that the bank already has all of your information, so you only need to provide data for the recipient. However, banks charge much higher fees than other providers, and the exchange rate they offer on international transfers can also be punitive. So while convenient, if you send money frequently, or are sending a large amount, this route will cost significantly more.

PayPal

Some online payment sites, such as PayPal and WePay, can link to your personal bank account, and via this method you may be able to send money to others, either within Canada or abroad in a different currency. PayPal charges its own fees, based on the amount being sent, so the affordability of this route varies depending on your use.

Post Office

Lastly, those without access to more convenient methods can send money to others by going to their local Post Office (or branch of a money transfer company) to arrange the transfer in person. Depending on where you go to do this, the fees can vary, but they are typically less competitive than those offered online.

Why do People Use Money Transfers?

There are many different reasons people use money transfers, both within Canada and internationally. These include:

- Covering medical expenses

- Buying property

- Paying for vacation expenses

- Paying other international bills

- Sending money to family and friends

- Supporting family members in other countries

- Paying for overseas tuition

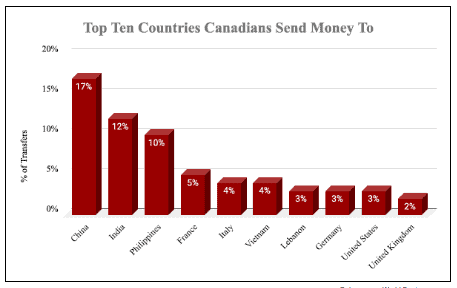

Canadians use money transfers a lot, sending an average of $30 billion overseas every year. And over 1.6 million Canadian households use money transfers just to send money to family and friends living abroad.

Benefits of Online Money Transfers

Performing a money transfer online is rapidly growing in popularity, because they are:

- Convenient - they can be done entirely from home. Many online services have dedicated apps, so all you need is your phone. And you can set up permanent accounts, so if you send money regularly to the same person, you can speed up the process, or even automate it.

- Fast - money is routed instantly and arrives quickly, in anything from a few hours to a few business days.

- Safe - websites offering these services are secure, and there is no risk of physical money or cheques being lost or stolen.

- Cheap - in comparison to other alternatives, fees and exchange rates for online transfers are very competitive, and will save you money.

- Flexible - many online services offer dozens of currencies and the ability to transfer money to hundreds of countries.

Frequently Asked Questions About Money Transfers

How do money transfers work?

Money transfers work by simply deducting the required amount from your account, and placing it into the recipient’s account. There is no need for physical cash or cheques; a money transfer can be sent within Canada or abroad, and in Canadian dollars or other currencies.

How do I send money abroad?

Sending money abroad has never been easier, thanks to the rise in online money transfers. You can use an online money transfer company, or sometimes your bank, to send money to people outside of Canada. You’ll need their contact and banking information to set it up.

How much does it cost to send money abroad?

The cost to send money abroad varies depending on the provider you use to transfer the money, how much you’re sending, and if there are currency conversions to take into account. Banks are an expensive way to transfer large amounts or foreign cash, and can charge anything from $20 to $100 per transaction. Online transfer companies are typically the most affordable option, charging a set low fee.

How do I pick the best money transfer provider?

Picking the best transfer provider is often a case of finding the most cost-effective for your needs. Consider the fees and exchange rates offered by different providers to see who is the cheapest; then consider the processing time, and how quickly you need the money to arrive at its destination. Lastly, check the small print for any restrictions, such as limits on how much you can send. All of these factors taken together will inform you which provider best suits your needs.

How can I transfer money online?

Transferring money online is easy; you can do so via your bank, if you use online banking. Do this by logging into your account and clicking the option to transfer money. If you’re hoping to use a dedicated money transfer company, again very little effort is required. You can create an account within minutes, and link it to your bank account. As long as you have your recipient’s details, you can then decide on the amount you’re sending, and click “send.†The money will be deducted from your account, and will arrive in the recipient’s account within a few days.

Is it safe to transfer money online?

Online banking transactions, including online money transfer services, are processed in Canada by the Automated Clearing Settlement System and the Large Value Transfer System. These agencies have risk-control mechanisms and government oversight to ensure secure financial data transmission. This means that it is considered safe to send money online and you should not be worried about your personal information; but it is important to check you have the recipient’s correct banking details, to ensure the money is deposited in the right place!

How do money transfer companies work?

Money transfer companies work by charging a small fee for each money transfer they handle. This fee is deducted from the funds sent and funds their business.

Written by Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star in 2019.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice