Top Credit Unions in Canada

What is a Credit Union?

A credit union is a “near-bank†financial institution; this means that it offers many of the same products and services as a traditional bank, but it is structured differently, and regulated separately. Credit unions have existed in Canada for over a hundred years. The major difference between credit unions and banks is that banks are run as for-profit companies, but credit unions are non-profits - they do not make money from their customers. They still however can be used for many day-to-day banking needs.

How do Credit Unions Work?

Credit unions are owned by their account holders. By having an account at a credit union, you automatically become a “memberâ€; as a member you then become a co-operative part of the financial institution. If the company makes a profit, it can either reinvest that profit into its services to better help its members, or it can pay out that profit to its members as dividends. This means that as a member of the credit union, you participate in its success. Members also get a say in how the credit union is run via a volunteer board of directors, elected by the members from their own number.

Credit unions used to be used as financial institutions for people sharing a common bond; for example, employees of a certain company, or members of the armed forces. Nowadays though, credit union membership is open, and anyone can become an account holder (and therefore member) in a Canadian credit union.

Who Regulates Credit Unions?

Credit unions are regulated by either the provincial or federal government. Most institutions are provincially regulated, but since 2012 credit unions can register to become “federal credit unions†and be regulated by the Office of Superintendent of Financial Institutions - an arm of the Government of Canada. There are only two federal credit unions in Canada, and over 240 standard credit unions. Almost all of the credit unions in the country belong to the Canadian Credit Union Association, which monitors the market and assesses the health of Canada’s credit unions.

Credit Unions in Canada

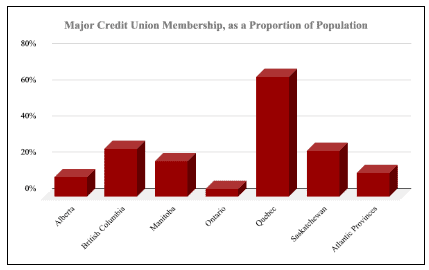

Canada has the world’s leading participation (per capita) in credit unions, with over a third of the population belonging to one. The trend is much stronger in Quebec though, where almost 70% of the population belong to a credit union (also known as a caisse populaire). There are no credit unions in the Territories.

Credit unions have a big impact on communities across the country, as they often invest in local programs and charities to help better their members’ lives. They also engage in educational programs to increase financial literacy.

Credit Union vs. Bank

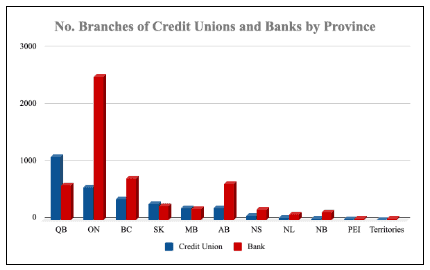

Although the two may seem similar on the surface, there are differences in being a customer at a credit union than at a bank. Credit unions can typically offer better interest rates, lower fees and superior customer service than banks, but they can also be less convenient. There are generally fewer physical locations for credit unions (although there are still plenty of ATMs that credit union members can use for free), and they may not offer the online or mobile banking options you are used to. There is also the possibility (especially if you are seeking less common products) that a credit union may not offer every service you need.

What Services do Credit Unions Provide?

Credit unions provide many of the same services that banks do, including:

- Chequing accounts for day-to-day banking, deposits and withdrawals, paying bills, and accessing cash.

- Savings accounts for ring fencing funds for a specific purpose, and to earn a higher interest rate than available via chequing accounts.

- Mortgages to help you purchase a home.

- Business loans to assist with your business’s needs, such as expansion, equipment purchase, and so on.

Retirement savings plans to help you plan and save for your retirement.

- Retirement savings plans to help you plan and save for your retirement.

- Wealth management services to help you maximize the interest you earn on your money, while staying tax efficient and minimizing fees.

- Credit cards, available through partnership with Collabria, to assist with your cash flow management and give you access to short term borrowing options for everyday purchases.

- Investment accounts to help you maximize the interest you earn on your savings and provide you access to the investment vehicles you are interested in.

Frequently Asked Questions About Credit Unions

What is a credit union?

A credit union is a financial institution that offers many of the same services and products as banks, but they are structured and regulated differently, and run as non-profits. Many people use credit unions for their everyday banking needs.

How do credit unions work?

Credit unions are run as non-profits, meaning that their aim is not to make money from their customers. They work by all account holders becoming “members†of the credit union, meaning that you participate in the union’s success if it does well. Credit unions in Canada are treated as financial institutions and regulated as such by either the provincial or federal government.

How do credit unions make money?

Credit unions make money in much the same way banks do: by charging interest on loans and collecting account fees. The money earned from these activities is reinvested in the credit union, or paid out as dividends to its members. As credit unions are run as non-profits, they are not subject to the same taxes as banks, and so have lower costs to run as well.

What are credit unions used for?

Credit unions can be used for a wide range of day-to-day banking needs, such as chequing and savings accounts, mortgages, credit cards, loans, investment services, and so on.

Are credit unions safe?

Credit unions are protected by either provincial or federal deposit insurance programs, so the money you hold in a credit union is as safe as money in a traditional bank. Canada has one of the world’s healthiest financial services sectors and is considered very sound.

How do I pick the right credit union?

Picking the right credit union starts with identifying which companies exist in your province and area. Depending on where you live, you may have excellent or non-existent access to a credit union. Once you know which credit unions are near you, you can compare the services they offer, to ensure you find one that meets your specific needs. Then compare rates and fees to find the best deal for you.

What do credit unions offer?

Credit unions offer their customers basic day-to-day banking services, but with lower fees and higher interest rates than traditional banks. They also offer participation in the credit union’s success, through the possibility of dividends. In addition, credit unions are often active in their community.

Who regulates credit unions in Canada?

Credit unions in Canada are regulated by either the provincial government of the province they are located in, or by the federal government if they are a federal credit union.

How many credit unions are there in Canada?

There are over 240 credit unions in Canada.

Who owns the credit unions in Canada?

Credit unions are owned by their members - the people who have accounts at them. In this way, credit unions differ from traditional banks. There are no shareholders; every person with an account owns a stake in their credit union.

How can I switch credit unions in Canada?

You can switch credit unions (or from a bank to a credit union) easily. First you must select your new institution. Open the account(s) you need at your chosen credit union; switch all of your automatic payments and deposits from your old institution to your new one. Then close all of your old accounts. This process is made easier by the fact that many credit unions allow you to open new accounts via their website.

What is the difference between a credit union and a bank?

Credit unions and banks offer many of the same products and services, but they differ in how they are structured. Banks are for-profit companies, regulated by the federal government, whereas credit unions are non-profit organizations regulated by either the provincial or federal government.

Written by Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star in 2019.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice