Top Accounting and Invoicing Software in Canada and US

Why Use Accounting Software?

Every business that brings in even a decent amount of revenue uses accounting software. It is simply too unproductive not to.

There are many benefits to implementing an accounting software solution into your business. Choosing a modern accounting system helps companies to simplify processes, mitigate workloads, install more transparency into their organization, and improve financial forecasting. Other benefits include:

Simplify Work Processes

Accounting systems do much of the heavy lifting for you that in previous decades would have had to be handled by hand. They make it possible for a person without accounting experience to effectively track their transactions and keep a birds-eye-view of their finances with automated calculations.

This makes accounting software a no-brainer investment for small business owners, who have to oversee their operations while ensuring that their business meets all regulatory and legal standards — which can be a tall order for companies with few employees. When you have to wear many hats, the last thing that you want is to be tracking your finances in a spreadsheet.

Save Money

Accounting and invoicing software will not only help you to charge your customers but will automate calculations and reporting that gives companies insight into their revenue operations that would otherwise be overlooked. Normally, companies would have to hire someone in-house or outsource to an outside expert to generate actionable reports from their financial data. However, most modern accounting and invoicing software include reporting features that give you a top-down view of your business. Additionally, accounting software allows companies to reduce costs on storing and securing sensitive data, as most modern solutions are cloud-based and provide security for you.

Financial Transparency

For accountants and auditors, accounting software is a savior. It ensures that companies are organized, with categorized transactions so that when it comes down to tax season, everything is straight-forward. This also helps companies to avoid a tax-time crunch and deal with any audits that come their way. When everything is organized in accounting software, taxes become much easier to process.

Improved Forecasting and Estimates

Being able to forecast your company’s future is critical for making data-backed decisions. Accounting software gives you a top-down view of your financial performance and makes it easier to spot trends as they emerge.

With an organized accounting system, you’ll have a better understanding of where you need to cut expenses, areas you should invest in, and where your budget is being wasted. A full view of your current financial status allows you to make smarter decisions and develop long-term strategies with foresight.

Improved Productivity

Using accounting software will improve productivity for your teams. Seeing where your money is going allows you to break down the tasks that your teams perform on a daily basis to better understand what tasks are paying off for your company and what activities can be placed on the backburner. Additionally, your financial team will have an easier time accessing, reporting on, and internally sharing financial information.

Tax Compliance Issues

The top accounting software available today provides features like payroll assistance and tax compliance automatically. They will factor in key information — such as the origin country of your payments, categorize the payment correctly, and either automatically handle or make recommendations so that you can adhere to local tax laws. Accounting software delivers a transparent workflow that makes compliance and tracking compliance much easier.

Security

If you were to pay for your own in-house accounting solution, you would also have to put the right security measures in place for that data as well. Modern accounting systems provide security for you. Often, the data will be hosted on their servers, although you always have the option of exporting or keeping copies of the data for your own purposes. Leveraging their experienced security infrastructure is often a better solution than trying to hire your own in-house data security experts. Protecting customer data is critical.

Accounting software can deliver many benefits to a business. It allows you to streamline work processes, provide a top-down view of your financial position, and enable you to make data-backed decisions that will push your business forward.

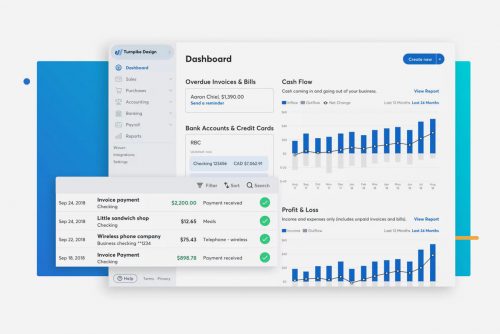

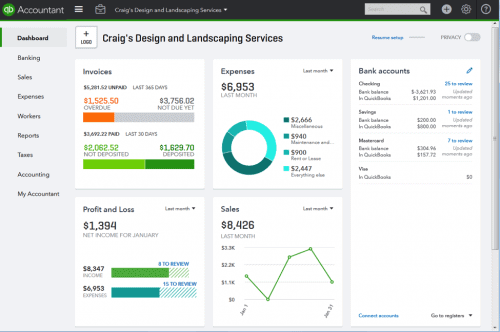

What Are The Top Accounting Software Features?

The “Accounting and Invoicing Software†category is a big one, filled with many different options. Some of those solutions are more niche than others, offering accounting solutions for very specific types of businesses and needs.

Generally, some of the main features that are included in most modern accounting solutions include:

- Accounting. The main component. This includes features like a general ledger, accounts payable & receivable, asset management, and bank reconciliation. Those are the base-level accounting features that will be included with almost any modern software.

- Billing and Invoicing. Your accounting system needs to be able to track payments received from customers and automatically categorize them in your system. There are complete software systems that are only dedicated to this task. It’s an integral piece of any financial operation. These features typically include multiple options for processing payments.

- Budgets and Forecasting. Modern accounting software also includes solutions for complete financial management, including budgeting and forecasting. Keeping your spending in line with your budget is imperative for the financial health of your organization. Likewise, being able to accurately predict what your future financial situations will look like are just as important for making the right decisions in the here and now.

- Payroll Management. Modern accounting solutions typically offer a range of features for managing your payroll, including processing and calculating employee payments, preparing and printing their paychecks, and responding to legal and tax regulations in the process. This is critical for growing businesses who expect to see their workforce grow in the coming months.

- Inventory Management. Inventory management is a must-have for E-Commerce and brick-and-mortar businesses that sell products. The only question is where you get it from.

- Project Accounting. Some accounting software allows you to break down your categorized expenses in ways that give you more insight into how spending across all of your projects looks. When combined with other analytics solutions, you can connect that spending to generated revenue to hone in on the activities that drove your business forward.

What To Consider When Choosing an Accounting Software?

Accounting software is a choice that will play a critical role in your company for years to come. It’s important that you find the right solution for you. While it is possible to migrate from one accounting and invoicing system to another, it generally is time-consuming, difficult, and error-prone and should be avoided if possible.

Before making your decision, there are a few things that you should consider when making your decision.

Ease of Use

Adoption is so important when it comes to accounting systems. You want to make sure that your teams use your system as intended. An accounting system that is difficult to use also impedes productivity and reduces the chances of accurate financial forecasts.

Integration Considerations

If you have been using an offline system for accounting for years, you’ll want to think about how difficult it will be to import that data into your new system. Often, your accounting and invoicing software will have in-depth documentation and procedures that you can follow to import data from offline systems. Still, you need to make sure that you can load previous years’ transactions when you move to a new system.

Payroll Requirements

Does the accounting software of your choice calculate payroll data for you, or is that something that you will have to do yourself? Make sure that you have an understanding of what payroll features you will need, if you need them. Some accounting and invoicing software will integrate with third-party payroll systems as well, which is something to consider.

Users Needed

How many people within your organization will need access to the software? Often, software-as-a-service accounting solutions will feature a monthly fee, and often that fee is anchored to either revenue amounts, or to the number of users that will need access to the system. This can have a huge impact on the final price that you pay, so it is best to go into evaluating accounting apps with a number in mind.

How Much Does Accounting Software Costs?

The amount that you can expect to pay for an accounting solution depends on a few factors. While most modern solutions are subscription software packages with a set monthly price, there are still on-site and offline accounting systems, although those are typically more often considered by larger enterprise companies.

Other things that can affect the price of your accounting system include needed features, integrations, implementation, training, and ongoing support needs. Each solution will have its own pricing considerations and structure.

While you should evaluate each solution differently, here are some examples “starting at†prices for popular accounting applications.

| Software | Price (Starting At) |

|---|---|

| AccountingEdge | $149 (One-Time) |

| Quickbooks Online | $15 Per Month |

| Rydoo | $6.75 Per User |

Finding the Right Accounting Application

Finding the right accounting software requires research and due diligence. Define the features and traits that are important to your organization and slowly begin to narrow down the list of available options. Your choice of accounting software will have a huge impact on your business for years to come, so there is no need to rush the decision.

Frequently Asked Questions About Accounting and Invoicing Software

How does accounting software help?

Accounting software allows you to speed up work processes, save money, and install financial transparency in your organization.

How much does accounting software cost?

Accounting software pricing can depend on a number of variables. It may be a flat monthly rate or charged per-user, per-transaction, or on revenue-based considerations.

Does accounting software take care of my taxes for me?

No, not completely. But it does help to facilitate organization that makes tax time easier.

Is accounting software based in the cloud?

Often, yes. However, there are still desktop-based accounting solutions for companies that are security conscious.

Written by Smarter Loans Staff

The Smarter Loans Staff is made up of writers, researchers, journalists, business leaders and industry experts who carefully research, analyze and produce Canada's highest quality content when it comes to money matters, on behalf of Smarter Loans. While we cannot possibly name every person involved in the process, we collectively credit them as Smarter Loans Writing Staff. Our work has been featured in the Toronto Star, National Post and many other publications. Today, Smarter Loans is recognized in Canada as the go-to destination for financial education, and was named the "GPS of Fintech Lending" by the Toronto Star in 2019.

Discover Popular Financial Services

Why Choose Smarter Loans?

Access to Over 50 Lenders in One Place

Transparency in Rates & Terms

100% Free to Use

Apply Once & Get Multiple Offers

Save Time & Money

Expert Tips and Advice