Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

Sending money abroad can often be expensive and difficult, but it doesn’t have to be. TransferWise is an online account that allows people to send and receive money internationally. Available in 71 countries, they are a trusted, secure, and regulated currency exchange provider.

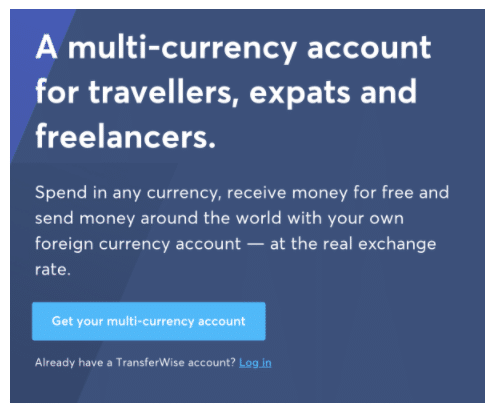

With a TransferWise account, you can send money worldwide, get paid in other currencies, and in some locations, spend money with the TransferWise Debit card. It’s a perfect solution for frequent travellers, the self-employed, companies working with clients in different currencies, or for people moving or living abroad.

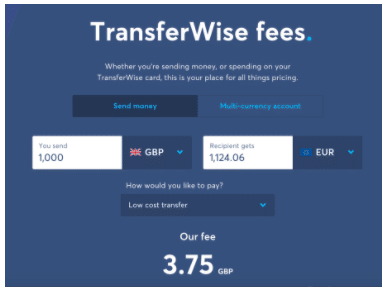

No one likes surprises, and TransferWise strives to be completely transparent with their fee structure. They offer:

TransferWise offers both personal and business accounts. You can do a simple one-time transfer, or you can register for a multi-currency account. This account allows you access to many features such as converting currencies and receiving transfers with no fees. You can also hold more than fifty currency balances.

Business accounts can help a company purchase inventory, pay invoices and even employees. Whether you are a small home-based business or a large enterprise, TransferWise can work for you by making your international payments less expensive.

In some locations, direct debits and debit cards are available. The TransferWise card makes it possible for you to spend the money in your account with none of the transaction fees that may be associated with bank cards.

Opening a TransferWise account is free. There are no subscription fees, monthly fees or minimum balances. Fees are only incurred when you send money in a different currency.

There are a few factors that determine how much your money transfer will cost. The total fees for your money transfer will vary depending on the amount you are sending. Part of the fee is calculated as a percentage of the transfer amount. How you chose to pay will have a small effect on your total, and of course, the current exchange rate. These fees can vary with different currencies. There is a minimum fee for small transfers as well as a flat fee for some transactions, depending on which country the transfer is being sent from and to. TransferWise uses the same exchange rate as the banks, but without any mark-ups or hidden costs.

No, TransferWise is not a bank; it is an electronic money institution. They do not offer overdraft or loans, and you won’t earn interest on the money in your account. There are, however, many benefits to signing up for an account with TransferWise. You can send, receive and convert different currencies all in one account. You will not pay any international transaction fees, and when transferring currencies, you will always get the real exchange rate with low fees.

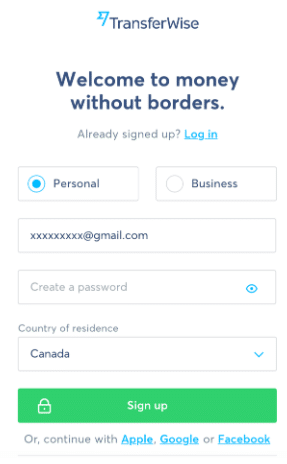

Opening an account with TransferWise is easy to do and should only take a few minutes. If you wish to open a multi-currency account, you will need to provide photo identification and proof of address, or, a photo of yourself holding your ID. A business may need to provide additional details, such as the location, type of industry and the owners country of residence. The verification process usually takes two business days.

To send money, you must create an account. You can sign up with your email address or connect with Facebook or Google. Next, you enter how much you would like to transfer, and fill in personal details, both your own and that of the recipient. You will be prompted to review and confirm the details and choose your method of payment. Your transfer will then be confirmed. You don’t need a TransferWise account to receive a payment, you only need a bank account.

TransferWise is a licensed Authorized Electronic Money Institution, which means they are regulated by numerous financial authorities in every country that they operate in. They use bank-level security to protect their customer’s transactions and make sure that all communications are secure.

A typical money transfer will be completed within one business day, and often even within minutes. Occasionally a transfer may take up to two business days, though this is not common. Some factors that may make a transfer take longer include: the country you are sending from or to, how you pay for your transfer, what time you pay, and if there are any further security checks or verifications required.