1. What credit score is needed for a business loan?

While there is no one magic number that enables small companies to receive the financial resources they need, a higher credit score works to the benefit of the borrower. As a general rule, higher credit rating (either the business, or the business owner) will increase the chances of getting approved for a business loan.

2. How important is cash flow in receiving business financing?

This depends on the type of business loan being obtained. For unsecured loans, cash flow is very important, because that’s how the lender evaluates the business’s ability to repay the loan. Daily and monthly sales numbers, especially through debit and credit cards, are a critical factor for business loan approval. For secured loans, where business assets such as equipment or real estate is used, the cash flow may be slightly less important.

3. Can I secure a business loan against intangible assets?

Yes. Intangible assets come in many forms – from intellectual property rights to accounts receivable – and it’s worth discussing with your chosen lender whether you have any that can act as collateral against your business loans. Collateral can significantly reduce the cost of borrowing.

4. How do I apply for a small business loan?

Having a well-drafted plan, clear financial goals, and the necessary documentation, such as financial statements and tax returns, is essential for instilling confidence in moneylenders and streamlining the application process. Being well-informed and adequately prepared not only increases your chances of securing financing but also ensures that your application aligns with the lender’s requirements, ultimately increasing the likelihood of approval for your business loan.

5. What is an SBA loan?

For organizations that have a track record of operations in Ontario and across Canada, the Small Business Administration (SBA) provides government funding programs through SBA-approved lenders in Canada. While the lender (usually a bank or other financial institution) provides the capital, the SBA guarantees up to 85% of the loan amount, which helps the business owner obtain a lower interest rate.

Depending on each individual business profile, the owner can gain up to $5 million of SBA-backed financing with loan terms from 5 to 25 years. However, an emphasis is placed upon credit scores and established histories when evaluating companies for qualification.

6. Can business loans be used for refinancing other debts?

When a business seeks financing from a bank, it’s essential to specify how they plan to use the funds they borrow, whether for marketing, technology upgrades, or debt refinancing. Transparency ensures alignment between the bank funds and the company’s financial objectives.

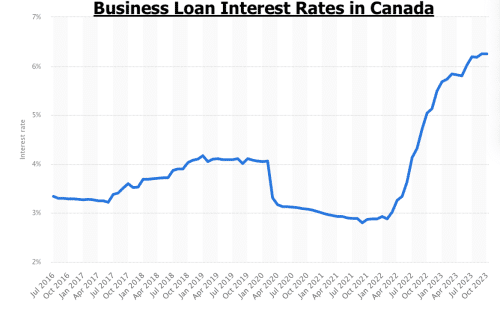

Refinancing with a business loan from a bank can offer several benefits. First, you can take advantage of reduced interest rates, leading to savings, capital gains, less profit eaten by debt payments, and a more manageable repayment process.

Additionally, you can consolidate multiple debts with varying interest rates into one loan, simplifying their payment schedule.

Lastly, by borrowing from a bank to refinance, companies can ensure their assets remain unencumbered, promoting financial stability.

7. When should business loans NOT be used?

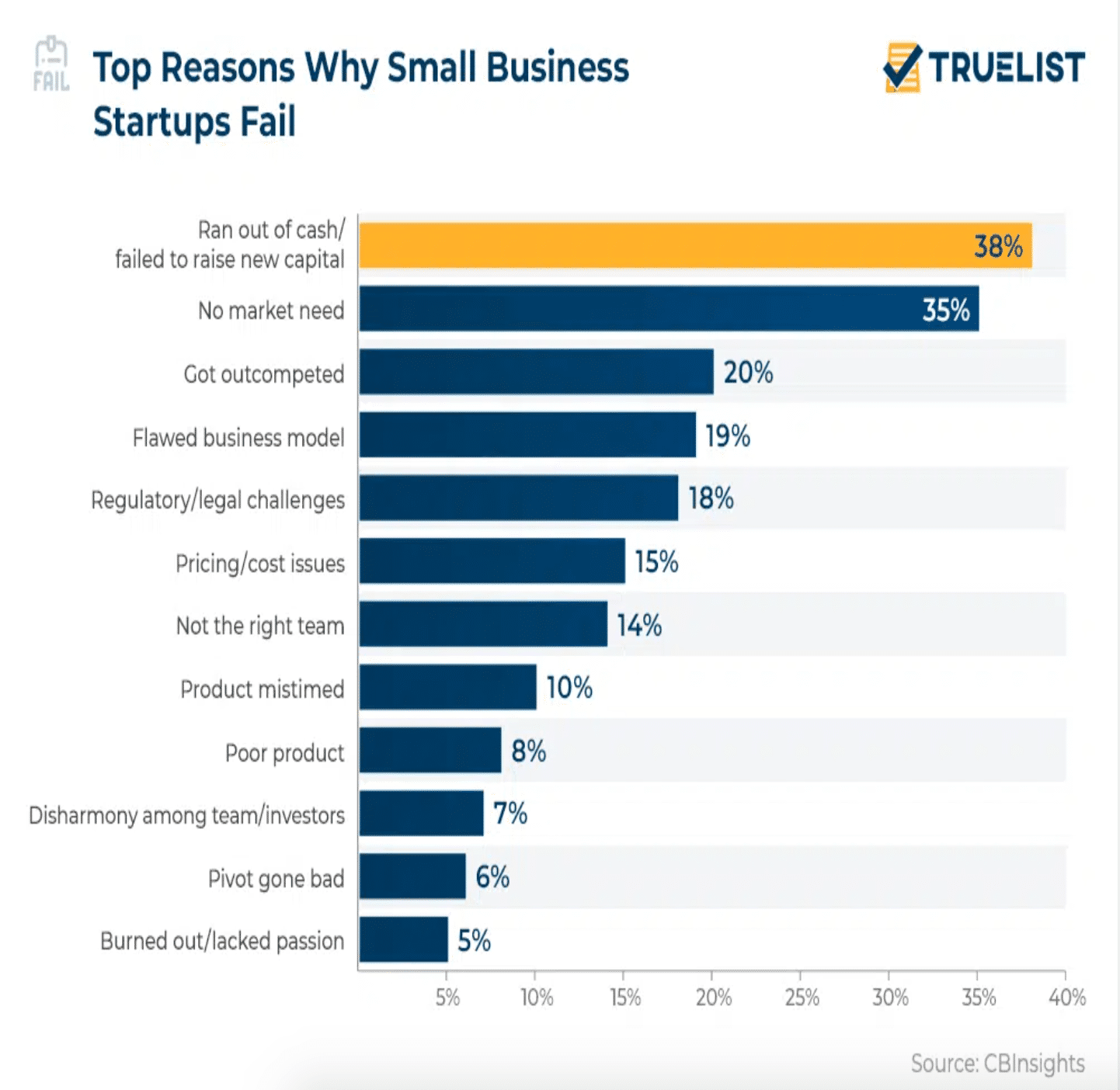

While it is ultimately the owner’s discretion and/or company policy that determines how the capital structure is formed, best practices for debt management include being vigilant with it, particularly in cases where the business is in trouble.

For example, it is not advisable to use a business loan to pay overdue bills and employee salaries when the business is not making a profit. Business loans should be used to increase revenue and grow a business, so that there is a positive return on investment after the funds are used up. A great example of this is purchasing inventory that is expected to sell during a busy season, or investing to open a patio for a restaurant, which will bring in extra revenue.

8. Who is eligible for a small business loan?

Small business loans are relatively easy to obtain as long as a business has been operational for at least a year and generates at least $10,000 in monthly revenue.

To qualify to apply for business loan and receive funding, business owners need simply to complete an application (online or at specialist lenders) and provide access to their business’s registration details and financial statements, as well as credit profile.

While size is not a direct consideration, lenders will want to look at a consistent history of revenue generation, so they can feel confident in a business’s ability to repay the loan.

It is worth noting that newer small business ventures in Canada can still receive funding, though it may not be with their usual bank. The government in Canada offers several programs aimed at helping start ups find funding; some of these are run through high street banks via the Canada Small Business Financing Program.

9. Is a personal credit score and business credit profile the same thing?

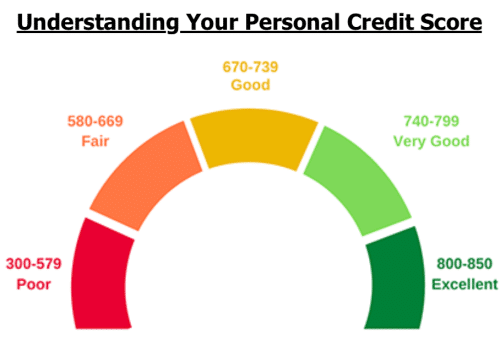

No, the personal credit score in Canada is a number between 300 and 900, with 300 being the lowest and 900 representing excellent creditworthiness. This score is a crucial factor in many financial transactions, including personal loans, mortgages, and credit cards. However, when it comes to businesses, there isn’t a direct equivalent to a personal credit score. Instead, credit bureaus in Canada have developed specialized scoring systems tailored to assess the creditworthiness of businesses.

10. Is a business plan necessary to obtain business financing?

This depends on the type of new or existing business loan being obtained. While most small business lending companies in Canada will want to see how the small business will deploy the funds, a well-formulated business plan may not be a requirement. In the case that it is necessary though, it is important to answer the bank the following questions:

a) What the small business loan will be used for (additional funding “cushions”, expansion, growth, equipment/technology purchase inventory purchases, working capital, funds for supplier/employee payments, capital expenditures, cash flow purposes etc.)

b) Expected business and economic conditions over the next 2-5 years

c) How they will impact profitability and financial strength

11. What’s the effect of loan applications on my credit?

Each loan application, whether approved or declined, affects your credit score. This is because each application involves the lender checking your credit profile, which causes a temporary dip in your score. This is why it is imperative to target your credit applications wisely.

12. Can a business based out of a home qualify for a business loan?

Absolutely, if the business meets the necessary qualifications set by the government, bank or the lender, it can indeed be operated from a residential living arrangement. This flexibility is especially valuable for small business owners and entrepreneurs who may not have access to a traditional commercial space or prefer to run their operations from the comfort of their homes.

13. Can I use a business loan for leasehold improvements?

Yes. There’s even a specific government program for this purpose! The Canada Small Business Financing Act (CSBF) offers financing to help with the expansion and modernization of Canadian small enterprises.

14. Can I apply for a small business loan online and use a business loan calculator for assistance?

Applying for small business loans online is extremely common, and is streamlined and convenient thanks to the many lenders who offer a business loan calculator online with their application process. Most lending institutions now have an online loan application option.

1-800-835-9618

1-800-835-9618