Frequently Asked Questions About Personal Loans

What do I need to get a personal loan in Canada?

While banks and other lenders will have different requirements relating to minimum credit score, credit history, and income level, the baseline loan requirement for all borrowers includes: Canadian residency, steady employment, a minimum age of 18, and a Canadian bank account.

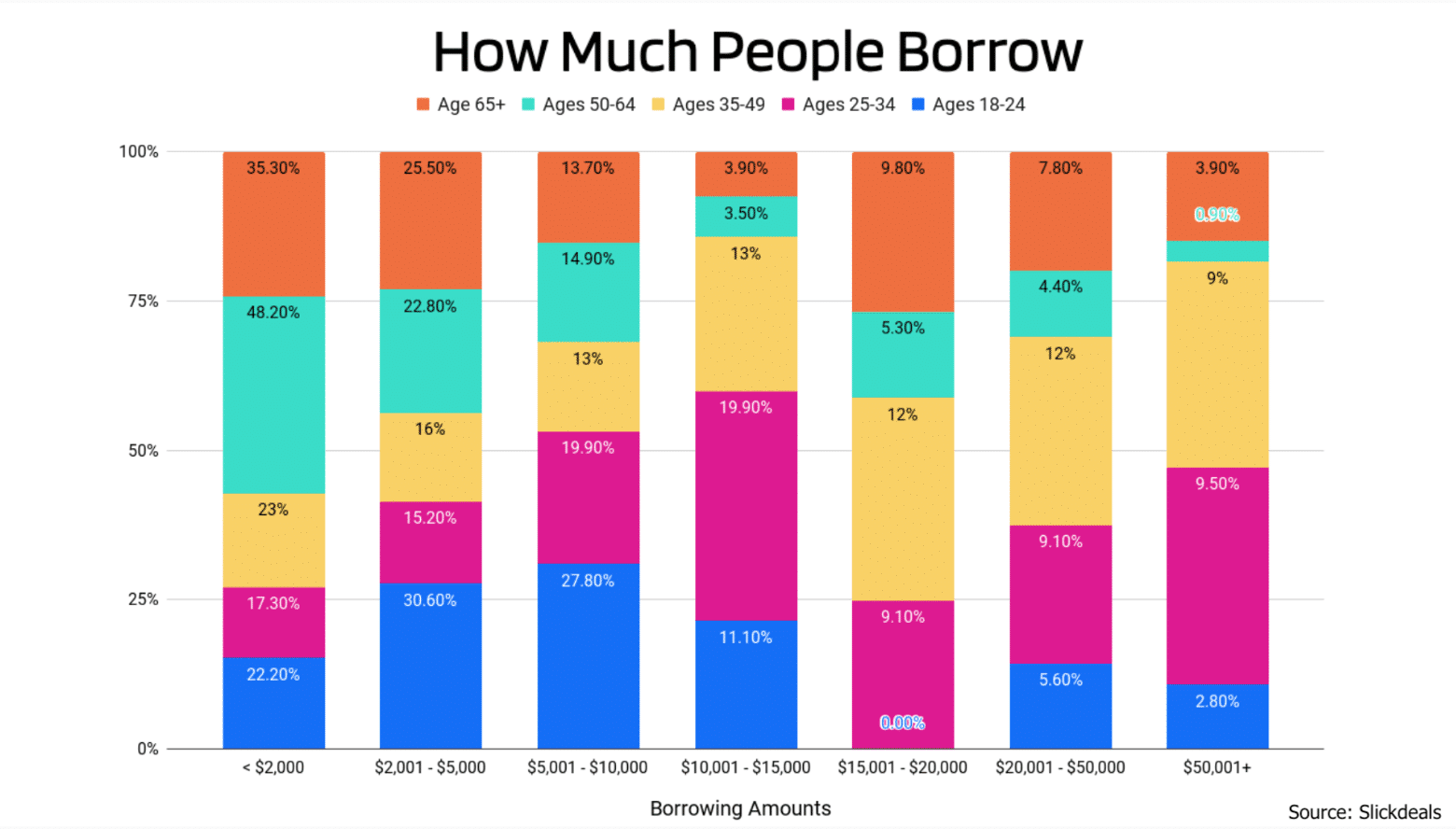

How much can I borrow with a personal loan?

The precise loan amount you can borrow will depend on your level of income, credit history, and willingness to put up a personal asset as collateral. Loan amounts are typically between $500 and $10,000, but can be much higher.

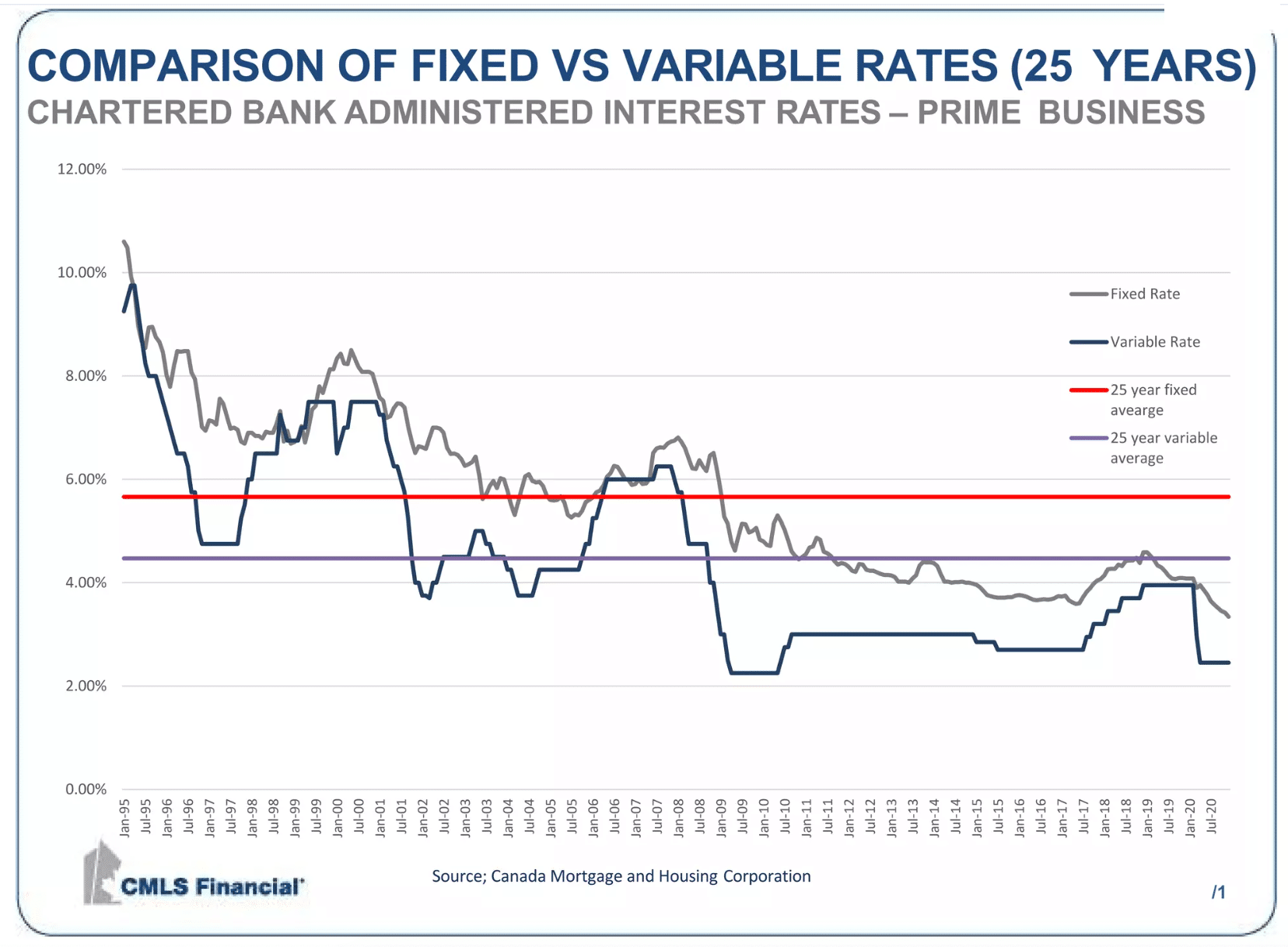

How are personal loan interest rates calculated?

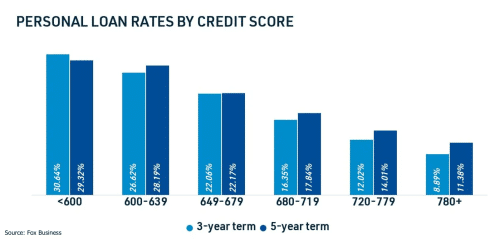

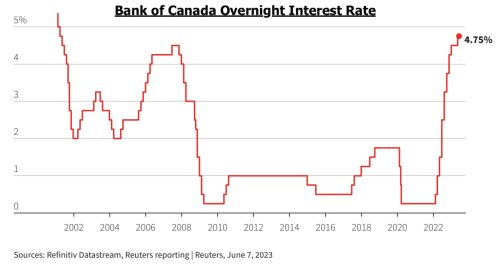

Personal loan rates are calculated using a combination of borrower-specific (income, credit score, assets, etc.) and macroeconomic (central bank rates, inflation) factors. Annual interest rates (APR) on personal loans can be as little as 4%, but may be as high as 40% or more.

Can I pay off a personal loan early?

While some personal loans have fees, they don’t typically come with prepayment penalties. An early payout could lower interest costs over the life of your loan, but it’s important to verify that your lender permits this before making a prepayment.

You may also want to consider renegotiating your loan agreement to change the payment frequency, if paying your loan off early is desirable. Bi-weekly or semi-monthly payments instead of monthly can help pay down your debt faster.

Can I get a personal loan with bad credit?

A high credit score will help you to secure a more competitive interest rate on a personal loan (and a higher credit limit on a line of credit), but it is not a necessity. If your credit report indicates a credit score that is less than optimal, you still have options, primarily from bad credit lenders and alternative lenders.

You can also mitigate the effect of a low credit score by applying for a secured loan instead of an unsecured loan. A secured personal loan is considered less risky by lenders as they can use the collateral on the loan in lieu of payment in the event of default.

How do I find out my credit score?

Finding out your credit score is easy, and there are several methods. You can access a free credit score report through various financial providers, usually online. The score shown on these is typically reflective of your ‘official’ score, but may not match exactly.

To find out your official credit score, you need to request it from a credit bureau. There are two in operation in Canada: Equifax, and TransUnion. Both will provide a full credit report, including items like your credit history, credit score, and even your Equifax risk score.

Can I access a personal loan online?

Absolutely; many lenders have online application forms, making it easy to apply and receive your loan entirely from home.

Are personal loans regulated?

Financial institutions in Canada are regulated at both the federal and provincial level. This duality affects borrowers in that their chosen lender (especially if it’s an online one) must adhere to the regulations wherever they are.

Here’s an example: let’s say a borrower, Joe, lives in Nova Scotia and applies for a loan from an online provider, like Fairstone Financial Inc. Although the company may operate across all provinces, and must abide by federal law, it also has to adhere to Nova Scotia’s specific regulations when it comes to the loan applied for by Joe. This can affect terms and conditions of the loan, as well as lender licensing requirements.

What happens if I don’t pay back a personal loan?

Paying back your debts is crucial if you want to protect your credit score and avoid the ramifications of default. In the instance of a secured loan, non-payment may result in seizure of your asset used as collateral. In the instance of an unsecured loan, the lender may pursue you through the courts for payment.