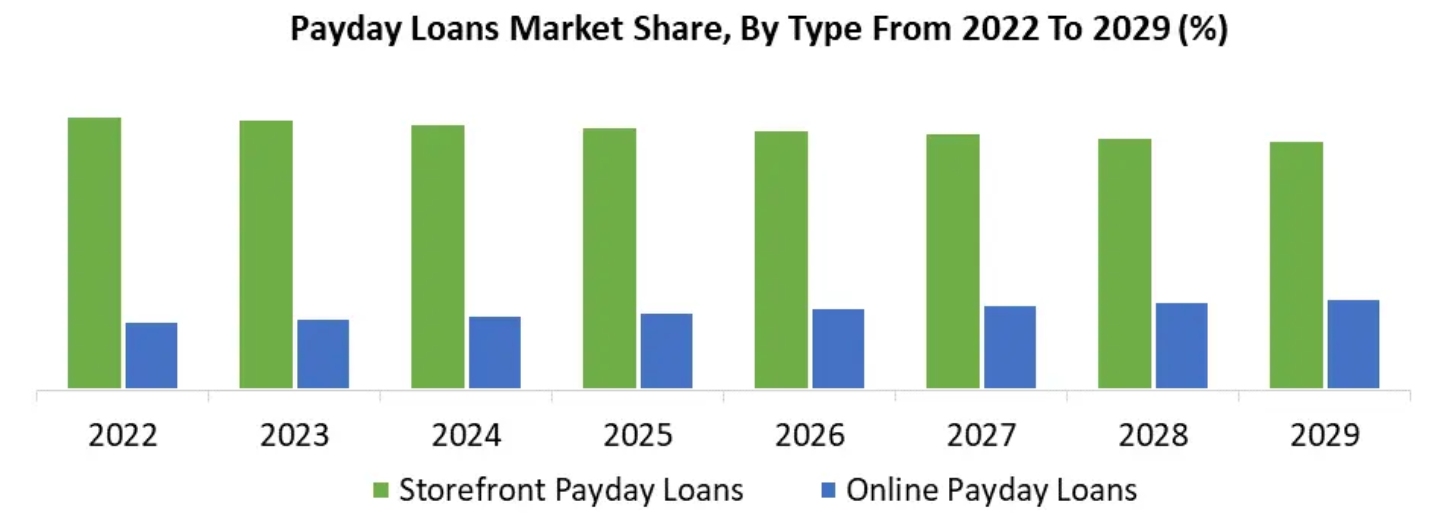

Can I apply online for a payday loan?

Yes, most payday lenders have easy application processes that can be accessed entirely online. This means you never have to go in store – not even to collect your money. Once funds are approved, cash will be deposited into your bank account via a transfer. You can apply today and receive approval – and your funds – almost immediately!

What’s the difference between a payday loan and a cash advance?

Most people use the two terms synonymously, but a cash advance can actually refer to two different types of funds: those received via getting a loan from a payday lender, and those received by taking money out from your credit card. The latter does not need any approval, and you can ‘borrow’ as much money as you like, up until your credit limit.

What do I need to qualify for an online payday loan?

Borrowers must be at least the age of majority in their province, have a steady verifiable source of income, access to a bank account, and a permanent address.

What counts as income for a payday loan?

The income needed to be approved for a payday loan does not have to be employment income; any form of income counts, including benefits, pension, royalties, and so on. The key is that you’ll be able to repay the money you borrowed.

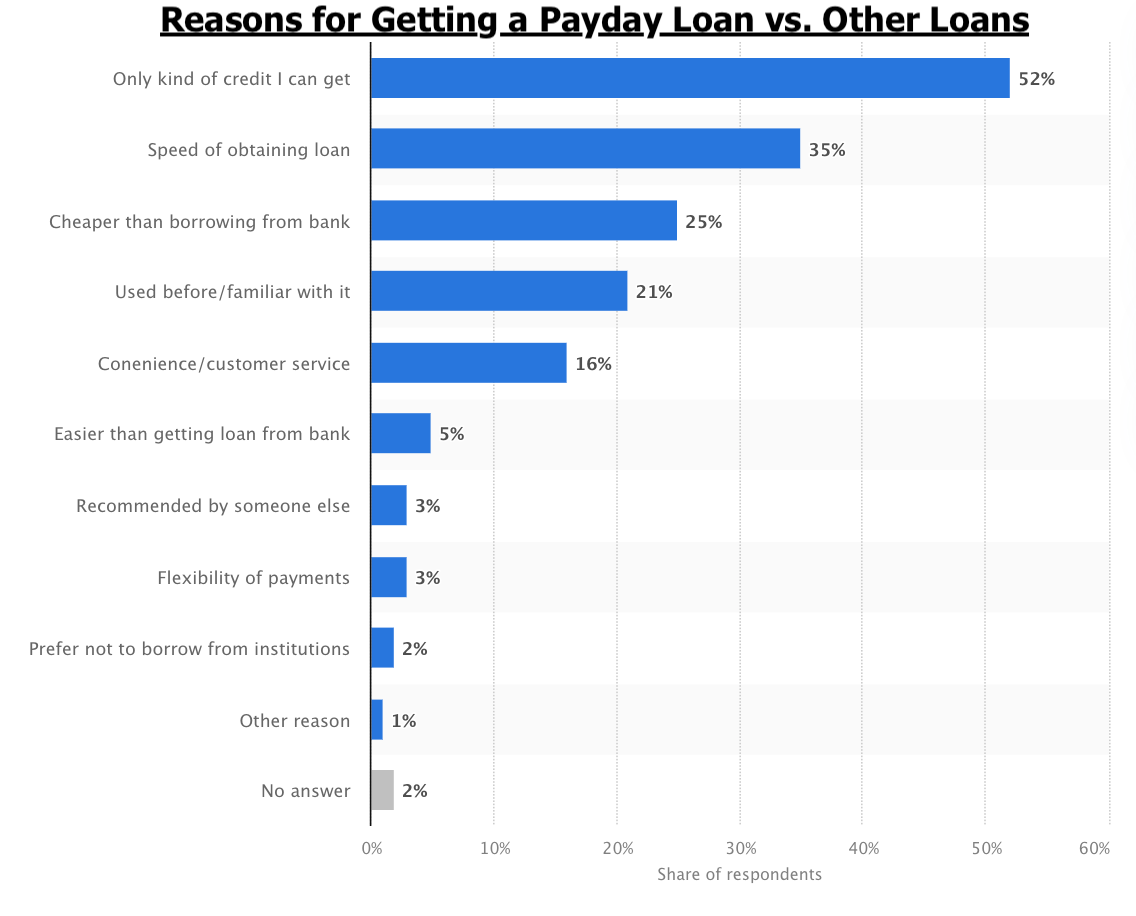

Can I get a payday loan with bad credit?

Yes. Payday loans are a very useful way to access cash for people that have bad credit and can’t get approval anywhere else. They are also intended for people who want to avoid a credit check, for any reason – even if they have perfect credit! Payday loans should however still be your last loan option, because they are expensive.

How quickly can I receive my payday loan?

Lenders typically approve payday loans within a day, and sometimes even within a few hours of submitting an application form. Cash is usually automatically deposited into your chequing account via a bank transfer. This makes a payday loan one of the fastest and most convenient ways to borrow money.

Do I need a bank account to get a payday loan?

Yes. You will need access to a bank account, and to provide that bank account’s details when applying for a payday loan. This is because the payday lender will transfer cash into your account. Those without a bank account will struggle to secure a loan of any kind.

Is using an online payday lender safe?

Payday loans are subject to regulation aimed at making them as safe as possible for consumers. However, this doesn’t mean there aren’t risks. You should always exercise caution when using any website to input private, personal or financial data, and ensure your connection and device are secure to prevent this information from being compromised when you apply online to a payday lender.

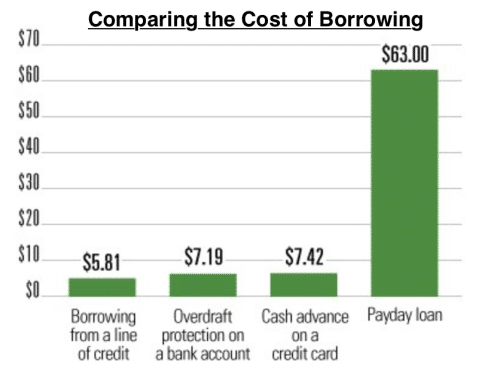

In addition to data security risks, if using a payday loan you should know that payday lenders charge the highest interest rate of any type of lender, meaning that payday loans are the most expensive way to borrow money.

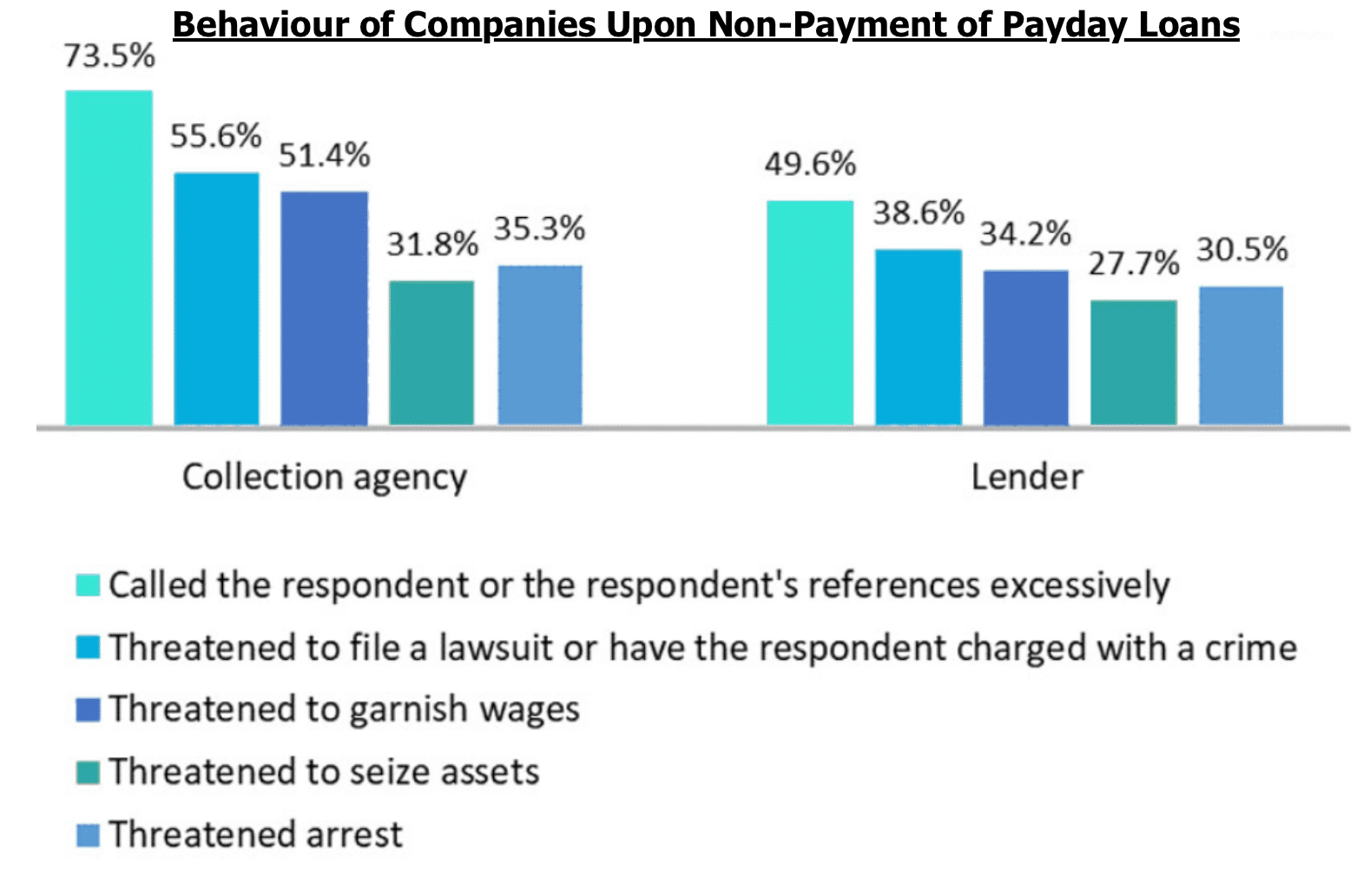

Am I at risk of a collection agency if I borrow money with a payday loan?

Yes, potentially. If you don’t make your loan payments on time, you will initially be subject to fees and interest; this interest will increase as time passes. Eventually, the lender may decide to pursue payment via a collection agency, or may decide to sue you for the debt. You can avoid the threat of a collection agency by making sure you pay back any money you borrow. Financial assistance is available if you’re struggling.

How long do I have to repay my payday loan?

That depends on the loan agreement you signed when taking out the loan and its stipulated pay periods. Most who borrow money via a payday lender do so with the intention of paying the money back within a few weeks. If you extend your loan beyond this, your loan may end up as a debt trap, requiring you to borrow more money to cover its cost.

Does my employer need to know I’ve taken out a payday loan?

No. While you need to be able to prove your income when applying for a payday loan (in order for the payday lender to verify you’ll be able to repay the loan), your employer does not need to know about the loan, and the payday lender should in no circumstances inform your employer. It is illegal for payday lenders to take payment in the form of automated pay cheque deductions.

How fast can I get my payday loan delivered to my bank account?

Your cash is typically delivered to your bank account within a day, but you could receive a deposit within just a few hours. And if you have online banking, this means that you can access money borrowed via this type of loan extremely quickly.

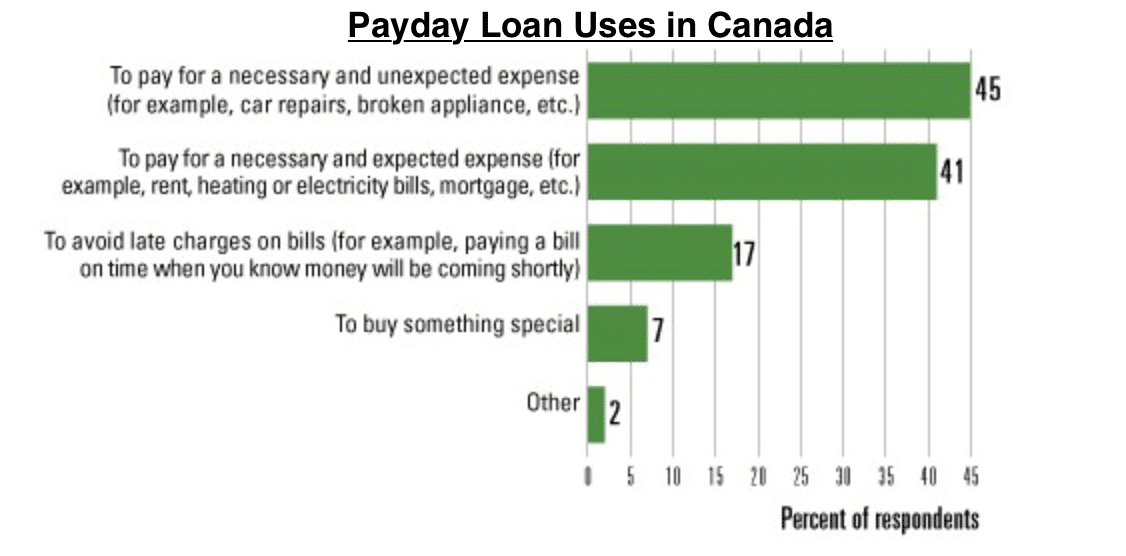

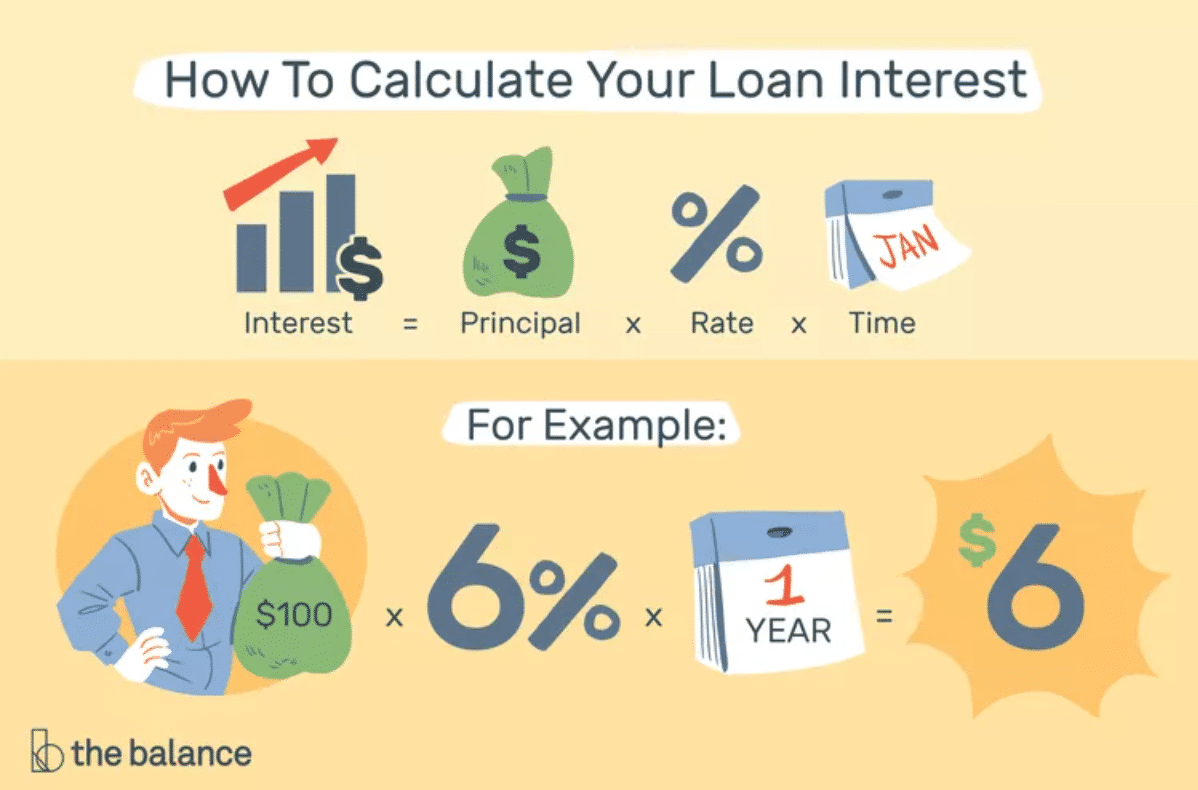

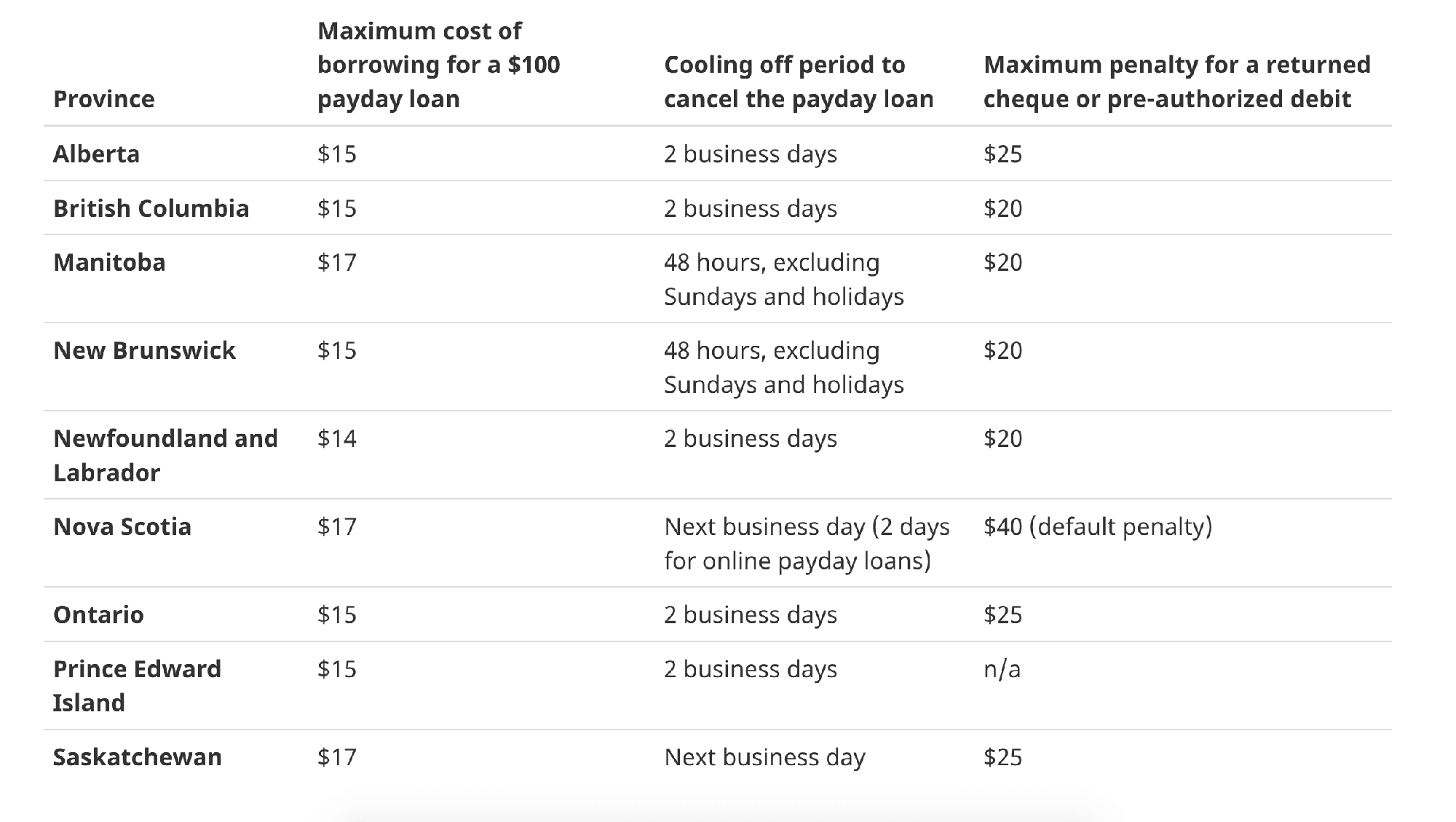

How much will a payday loan cost me?

That depends on which payday lender you go to, how much money you borrow, and for how long. Interest charges usually make up the majority of the cost, though there are fees to account for too. Hidden fees are illegal. Make sure you understand the entire cost of your intended borrowing before agreeing to it.

What’s the flat fee advertised in my payday loan?

Most payday loans are intended to be repaid in one lump sum, so their cost is often advertised as a ‘flat fee’ rather than as an interest rate. You’re likely to see a lender state something along the lines of “$15 per $100 borrowed” – but you should know that this is only if you pay back the cash on time, and does not account for fees, interest and other factors that will increase cost if you fail to repay on time.

How will I get my payday loan?

Most of the time, money borrowed via a payday loan will be automatically deposited into your bank account, or sometimes sent to you via an e transfer. This will be done very soon after your application is approved.

Can I increase my payday loan amount?

No. There are rules that state customers can only take out one loan at a time from each payday lender. You must repay all of the money you borrow before you can borrow any more.

Can I get a payday loan for my business?

No, not in the same way as you can as an individual. If your business needs to borrow money and is struggling to find a lender it can qualify with, the best option is usually a business cash advance. This short term financing option relies on the business’s ability to pay back the money borrowed (plus interest charges and fees) with expected business income.

For other borrowing options for your business, take a look at our business financing page.

Do payday loans build credit?

No, as even if you repay all of the money you borrowed on time, most payday lenders do not report payments to credit bureaus, so positive payment history will not be taken into account in your credit score. It is actually more likely that a payday loan will harm your credit, as high fees and an unaffordable interest rate make it much harder to pay back. The route to perfect credit is unfortunately not via this financial instrument.

How do I choose a payday lender near me?

With so many options to choose from, picking a payday lender can seem tough. To find one that works for you, firstly check whether the lender follows regulations. Then ask: are they transparent about fees? What are their reviews like? Do they mention their excellent customer service, or do they say it’s hard to get help? And lastly, assess whether their offerings work for you needs e.g. do they offer a guaranteed turnaround time, or have an online-only option?

Can I pay off my payday loan early?

Yes. You may be subject to a fee for doing so, but this varies by province. British Columbia, for example, has a low fee compared to other provinces.

What happens if I’m denied a payday loan?

If you’re denied a payday loan, it’s probably because you already have an active loan with that lender. Try applying through another lender. Or, work on paying off your outstanding debts and building your credit with services such as credit counselling or a debt management program, so you can more easily access other borrowing tools.

How much pay do I need in order to secure a fast cash loan?

Although payday loan approval is typically based on employment pay, as long as you have some form of pay coming in, it doesn’t actually matter where it comes from, or how much it is. All that matters is that you can pay back the cash you borrow once you receive your next pay. This means these loans are available to those receiving pay via benefits, child support and so on.

Is applying for a payday loan online safe?

The security of your personal information online will depend more on your personal set up than the lender’s security, as most reputable payday businesses in Canada have fairly robust security protocols. But you should know, if security is a concern, that you can complete an easy application for a payday loan in store. Most lenders are accessible in convenient locations.

What should I do if I don’t understand the payday loan terms?

Speak to someone before you agree to borrow money from a lender who you are wary of dealing with, for any reason. It may be that you can gain clarity by calling the lender, or visiting them in store. But if terms and conditions are opaque even after this, consider dealing with another financial services company.