Smarter Loans Inc. is not a lender. Smarter.loans is an independent comparison website that provides information on lending and financial companies in Canada. We work hard to give you the information you need to make smarter decisions about a financial company or product that you might be considering. We may receive compensation from companies that we work with for placement of their products or services on our site. While compensation arrangements may affect the order, position or placement of products & companies listed on our website, it does not influence our evaluation of those products. Please do not interpret the order in which products appear on Smarter Loans as an endorsement or recommendation from us. Our website does not feature every loan provider or financial product available in Canada. We try our best to bring you up-to-date, educational information to help you decide the best solution for your individual situation. The information and tools that we provide are free to you and should merely be used as guidance. You should always review the terms, fees, and conditions for any loan or financial product that you are considering.

– Free monthly reporting and credit monitoring

– Does not impact credit rating

– Equifax partner

– Easy to use mobile app

– Holistic financial solutions to help improve your finances

Canada-wide

Free

Mogo Finance Technology was founded in Vancouver 2003, offering a range of financial products including personal loans, identity fraud protection, mortgages, Prepaid Visa Debit cards and was one of the first companies in Canada to offer free credit score viewing, as well as free monthly credit score monitoring. As an Equifax partner, users are able to access the most widely used credit bureau in Canada without impacting their credit score. The company provides an online dashboard that can be accessed through web browsers as well as its Android and iOS applications.

Mogo also offers users a range of financial products, including mortgages, identity fraud threat detection, a simple way to trade cryptocurrencies, loan products and will even be launching a prepaid Visa card with cashback in the near future.

After arriving at Mogo.ca Canadians can sign up for a free profile by clicking on the sign up link, or create an account using the mobile app. Users are then asked to provide an email address and create a password, at which point they are sent a confirmation email, which directs them to the sign up page.

On the sign up page users are first asked for their first and last legal names, date of birth, address and phone number. The sign up sheet also inquires about housing status and monthly rent/mortgage costs, as well as employment type and income.

Once personal information is provided users are required to check the box next to all of the products they’re looking for, including an option for “monthly credit score.” The final step of the sign up process is to check the box that provides consent to Mogo to provide your personal information to the credit-reporting agency on a monthly basis, including a notice that says, “I’m aware that these initial and ongoing credit checks will not impact my credit score, which is pretty sweet.”

Once that information is completed the online application will ask some personal information specific to your credit profile to confirm your identity. This may include information about your credit cards, bill payment history, financial provider or age. Once that information is provided users are sent directly to their member dashboard, which includes credit scores and loan pre-approval amounts.

The company advertises that you can open a MogoAccount in 3 minutes, but it could actually take even less time, depending on how quickly you can type.

The company is also widely celebrated for its intuitive and easy to use application. Not only can users use the app to get their credit reports but they can also receive push-notifications when their score is updated each month. The company also offers a one-stop-shop for those looking to purchase cryptocurrency, apply for a mortgage, protect their identity and more.

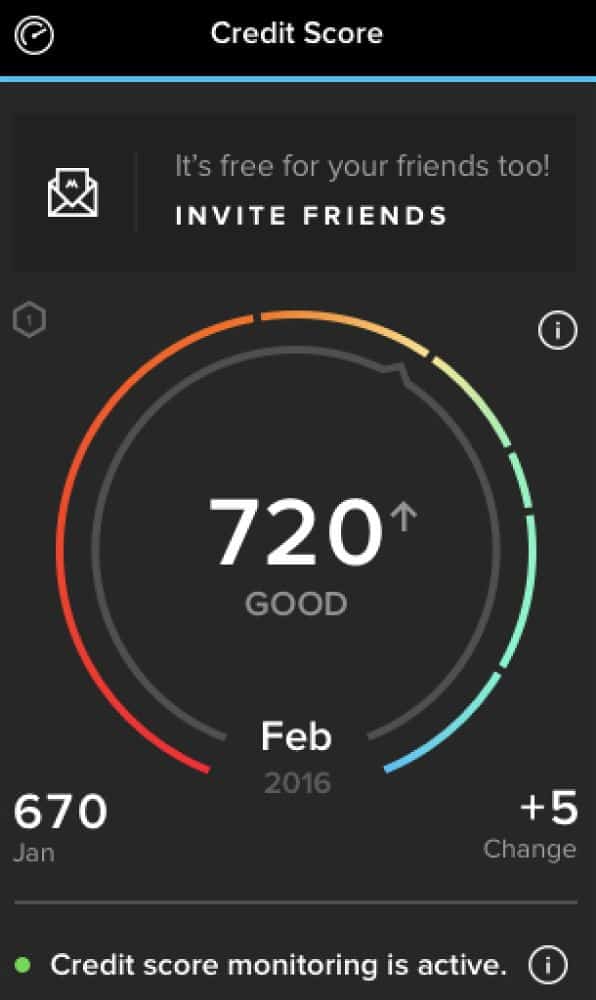

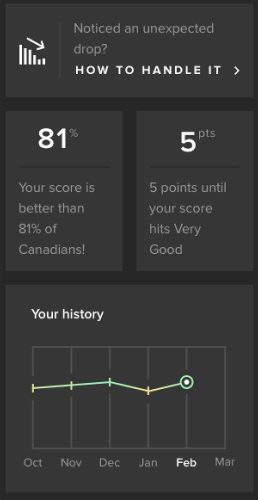

Not only are credit score checks free for users, but it also won’t impact the credit scores of those who take a look. In late 2016 Mogo overhauled their credit score dashboard to offer users even more credit information in an easy to use format. Now users are able to see their previous month’s score alongside their current score, their ranking on the credit score scale as compared with national averages, and detailed information about how their credit score has changed over the previous 6 months.

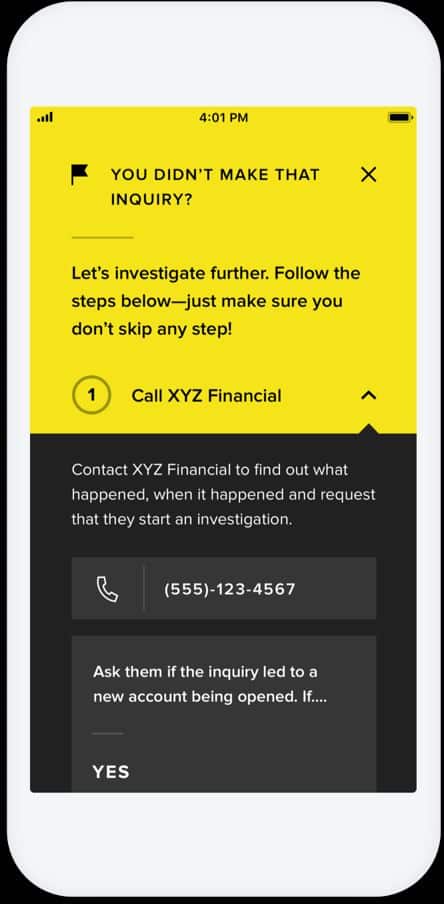

The dashboard also offers solutions to those concerned with their credit scores. For example, next to their credit scores users will see a button that says, “noticed an unexpected drop?” with a link below that reads “how to handle it.” Mogo also offers all of these services via a mobile app, which the preferred method of accessing Mogo services for many of their users.

The company also appeals to a younger demographic by offering an industry-leading mobile application, access to cryptocurrency trading and identity theft protection, among other products.

Mogo stands out from the crowd as the top choice for younger and more tech savvy Canadians. The service is ideal for Canadians on the go, and for a generation that prefers to order their food, rides and groceries on their phone. Though they offer many of the same services as other providers—including free monthly credit reports and advice on how to improve credit rating—they package them in a user-friendly dashboard and deliver them well on a range of devices. They are also unique for offering a cryptocurrency trading product and identity fraud protection. The MogoCard, an exciting upcoming product is another innovative twist – more on this later.

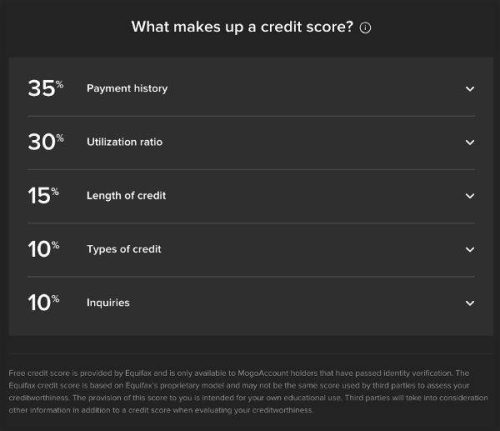

The Mogo dashboard not only breaks down the individual factors that impact credit scores, but also provides users with information about how significant those factors are in determining their score. For example, they show that inquiries only have a 10% impact, and the length of credit (I.E. how long you’ve had a credit account) accounts for 10% of credit scores, but that payment history comprises 35% of their overall credit rating.

“Missing a $4 dollar payment on a credit card for example could be as bad a missing a $400 payment, so don’t skip the minimum payment,” the company advises on its blog. “This also includes collections. Some creditors (even city parking ticket collectors) may report that you haven’t paid them to your credit bureau, or even use a third-party collection agency to get their money back. These collections on your credit bureau can lower your score. Always be aware of whom you owe money to—even if it’s just a parking ticket.”

It’s this sort of granular advice, coupled with an easy to use app and dashboard, which make Mogo the brand of choice for many Canadians.

Mogo’s free credit score tool is ideal for Canadians that want to either get a quick check-up or monthly reporting related to their credit score. Not only will checks not impact credit scores but the company even offers advice to those who are struggling to keep their scores up or just want some simple steps to improve. Both the mobile application and online dashboard actually break down the factors that impact credit scores and offer users solutions on how to improve them.

Furthermore, not all credit scores are made the same, but the one provided by Mogo via Equifax, known as ERS2, is one of the main scores used by lenders when considering a loan or mortgage application. As a result, Mogo’s free credit score tool is ideal for Canadians seeking one of those products.

Those who prefer to manage their credit score on the go would also enjoy their mobile application. In fact the Mogo app is one of the highest rated products of its kind in the App Store and on Google Play, with an average rating of 4.3 out of 5 stars across hundreds of reviews.

The only drawback of the service, if there are any to report, is the amount of offers and ads provided alongside credit scores, but it’s a small price to pay for an otherwise free service that won’t impact credit scores. Furthermore, most of those internal ads are for other free products or bonuses, such as links to the mobile app download or a “refer a friend” bonus, which offers users $5 in MogoCrypto for signing up another user.

Mogo offers a range of products to users checking out their scores. For example, users are offered access to their loan pre-approval amount, offered an opportunity to purchase or trade cryptocurrencies, identify protection, mortgage and prepaid credit card products. The good news is that these offers are by no means overly aggressive and do not have an adverse impact on usability. Furthermore, all ads are for other Mogo products and services, most of which are free or offer a referral bonus.

Here’s a video from Mogo’s YouTube channel that explains the suite of services from their point of view. Let’s take a closer look at the different products within Mogo’s full suite of services.

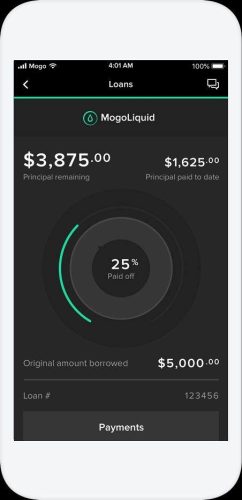

One of the core products at Mogo is an unsecured personal loan, also known as MogoMoney. You can get a loan from anywhere between $500 and $35,000, and if you are already using their free credit monitoring service, it’s that much easier to get approved and receive a quote. In fact, existing users can get a quote in under 3 minutes, according to the company’s website. Once a loan has been secured, customers can use the app to monitor their outstanding balance, manage payments and even access additional finances as they establish a relationship with the company and make on-time payments. Pretty nice!

Mogo offers different interest rates to different customers, and this flexibility is especially good news for those with better than average credit rating.

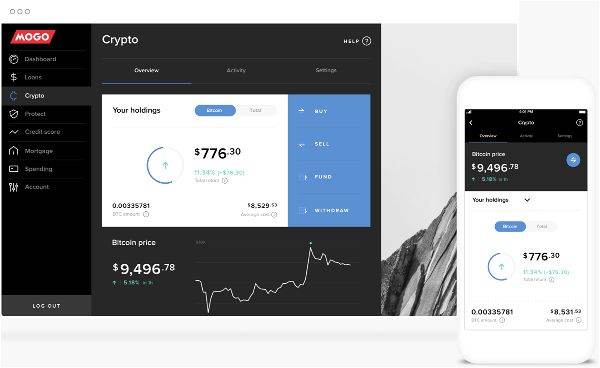

Though most are still struggling to understand cryptocurrency trading MogoCrypto offers Canadians an easy way to buy and sell bitcoin. The seemingly equal levels of excitement and scepticism surrounding bitcoin are largely due to concerns over the easy, cost and security of transactions when investing in cryptocurrency of any kind. With MogoCrypto Canadians now have a reputable company facilitating the process for them.

MogoCrypto is available to all Mogo users, and once signed up they are able to start using the product right away. In fact, there is a separate referral program for MogoCrypto which lets you earn $5 for each friend you refer.

MogoCrypto key features and benefits include:

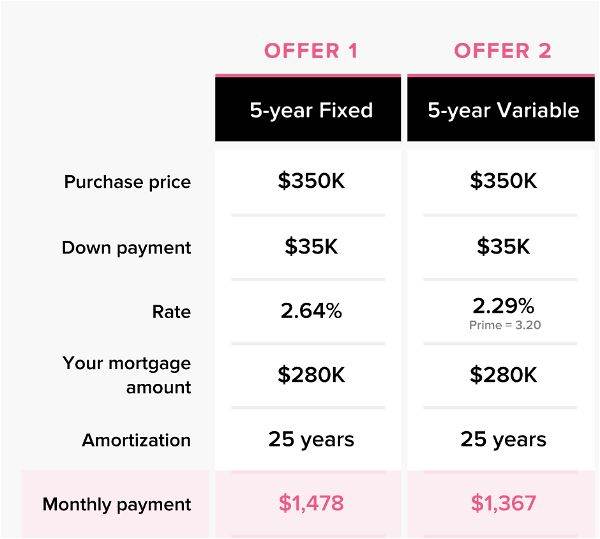

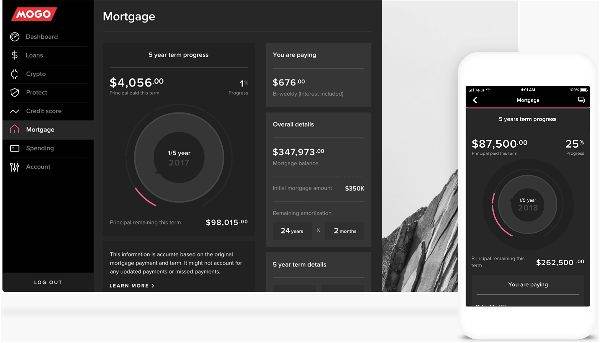

MogoMortgage caters to Canadians seeking to buy a home with a first time mortgage, or refinance their existing mortgage to get better terms. Like all Mogo products there is an easy to use dashboard that allows users to monitor all aspects of their mortgage, including their progress, outstanding balance and payments. Essentially, it is designed to help and motivate you to pay off your mortgage faster and save money over the long run.

After a quick application (again, your free credit score service helps smooth out the process), users receive several offer options to pick from.

It is important to note that Mogo works with other lenders to offer the MogoMortgage product, but has a dedicated team to support you throughout the process – similar to what you would expect from a typical mortgage broker.

Identity theft and fraud have become more significant threats as we continue to move more of our lives online. You no longer have to look too far to hear one of the many horror stories about identity fraud victims losing everything. Unfortunately, by the time someone realizes that their information has been stolen, it is often too late to stop the attack.

Fraudsters may use stolen information to take out a loan under the victim’s name or open a new bank account — activities that can be hard to catch until after all the damage is done. MogoProtect is designed to help you guard yourself from these risks.

By monitoring your credit bureau, Mogo is able to see any inquiries that are made into your Equifax credit bureau daily and alert you of this activity. This way, you will always be able to notice any suspicious activity and take action

This service comes at a monthly price of $8.99, but considering the potential damage that could be avoided, the peace of mind might be worth it.

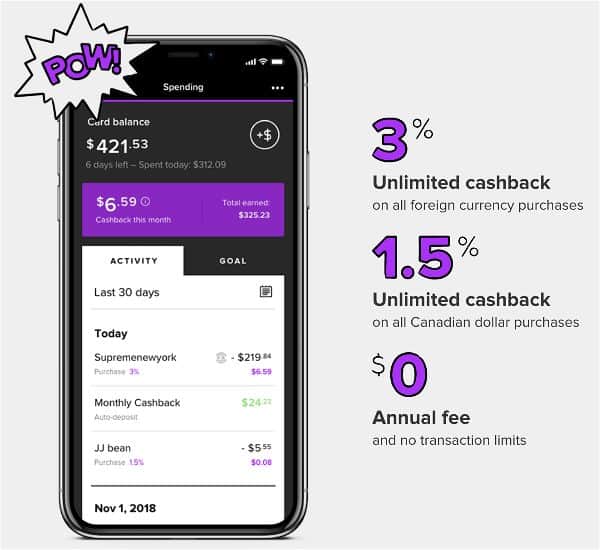

MogoCard is a brand new Cashback rewards prepaid Visa card; so new that it’s just rolling out as we’re writing this review, though early access is available for those with a MogoAccount.

The basic idea of the MogoCard is to give people the convenience of using a card similar to a debit card, but having it packed with perks, like Cashback rewards on every purchase and even spending tracking. It’s sort of like a debit card that offers all the awesome rewards and perks of a credit card only with absolutely no annual fees!

Highly recommended! Mogo took credit reporting and monitoring to the next level by integrating its service into a sleek app experience, which is a great fit for their target demographic. Since Mogo also offers personal loans, mortgages and cryptocurrency related products, a free credit score is a great compliment to complete the suite of services. This allows Mogo to pre-qualify users for their other innovative products, making it even easier to use those services. Those interested in a personal loan, for example, can now monitor their outstanding balance, payments and more, from the simple interface of Mogo’s mobile app. Based on our research, Mogo lives up to its slogan and is helping many Canadians to truly rule their finances.